Published: May 25, 2023 | Published By: Real Creative Agency

Lithium Bank Resource (LBNKF) Offers Big Upside Potential

OTC: LBNKF

Price $0.90 as of May 25, 2023

THE Incubator of Direct Brine Lithium Projects Reports First PEA with a US$2.7B NPV.

That equates to US $586M EBITDA per year for 20 years.

The GLOBAL race for lithium discovery is heating up, and ONE company has the LARGEST portfolio of direct brine district scale potential lithium brine projects in North America.

LithiumBank proposes to deploy Direct Lithium Extraction technology (DLE), making it the lithium stock with the BIGGEST POTENTIAL in this sector.

How so? Consider the following:

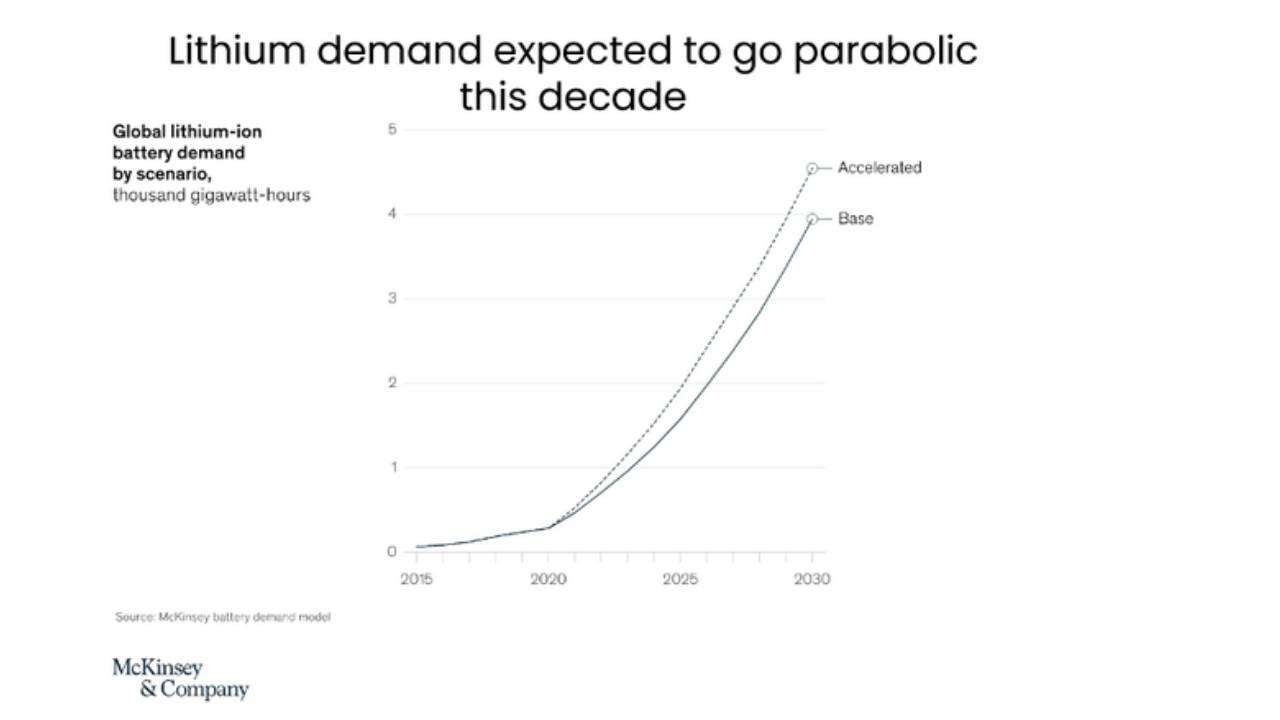

- Lithium is the “new oil,” and demand is expected to go PARABOLIC

- New technology extracts lithium in HOURS versus years

- Company has the LARGEST lithium brine district by lithium brine volume in North America

- FIRST PEA released today with a NPV of US$2.7B plus numerous expected near term enhancements

- At least 1 more PEA expected in 2023 on neighboring Park Place asset

- A portfolio of potentially FIVE or more distinct projects from 3 distinct districts in Western Canada

- Mining veteran (largest shareholder) has already sold Six PEA level projects worth over $2 BILLION to date

- Recent insider buying

LBNKF is a lithium resources company, NOT a mining company.

Quick Math for this Lithium (think) BANK here, NOT mining company:

Mining companies are typically bought for .20 – .40 of net present value (NPV).

However, we must keep in mind the unique business model in play here.

This is a RESOURCES company with MULTIPLE projects (where the extraction has been proven to be quicker and MUCH cheaper).

If we take that standard buyout ratio of .20 – .40 of NPV and multiply it by today’s PEA announcement of U. S. $2.7B, it would give a potential buyout JUST FOR THIS PROJECT of $540M – $1.08B!

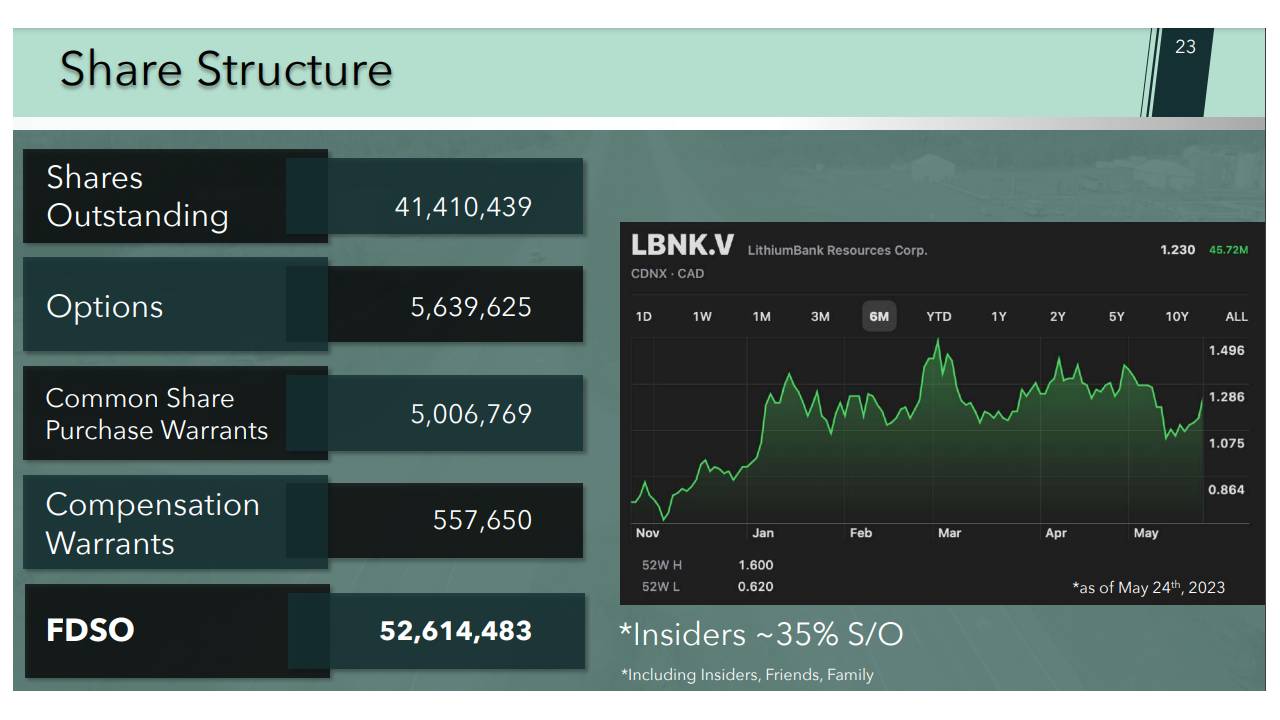

This simply equates to an additional $10 – $20 per share, based on their 52M fully diluted shares outstanding by our math.

This PEA alone is a company maker in our opinion, and sets LithiumBank well on its way to executing their remaining incubator of lithium projects strategy STILL to come.

With Boardwalk’s FIRST PEA representing only ~25% of its Sturgeon Lake confined Leduc reef structure by acreage and a Pre-Tax NPV worth US$2.7B, and if we assume a fully diluted share count of 52M and the FIRST Boardwalk PEA, an investment in LBNKF could deliver more than US$540M or +$10/share pre-tax value to shareholders on the basis of 0.2 X NPV with follow on upside potential from the broader portfolio of 5 or more additional projects.

Not only that, LB management is forecasting to deliver at least one more PEA by the end of 2023.

No other lithium developer in North America has more than two projects with a PEA.

Lithium Bank is the ONLY Lithium Brine Stock INCUBATOR.

Key to remember here, LithiumBank’s business model is unique because they are NOT a mining company, but a true lithium resources company.

If their 4 ADDITIONAL lithium brine projects have values anywhere near the one announced today, readers and investors can only imagine the potential share price appreciation those remaining projects could bring!

Additionally, using the standard .20 – .40 of NPV industry resource formula from above, it’s possible for a LBNKF investor to receive up to 5 ONE-TIME dividends OR spinoffs worth up to $10 EACH as well.

Certainly well worth considering when contemplating an investment in LithiumBank.

Lithium demand is expected to go PARABOLIC this decade.

“Lithium batteries are the new oil.”… Elon Musk

The combined demand for electric vehicle batteries and electric grid storage has created an unprecedented demand for lithium.

In fact, it’s the non-renewable mineral that makes the renewable energy transition possible.

Here’s the problem though.

The U.S. currently has only 1% of global lithium production or 1,000 tons… and yet the country represents the second greatest demand for the mineral (China is #1).

To that end, China controls most of the market for processing and refining lithium.

At the same time, the U. S. government considers lithium a “critical mineral.”

This simply means it’s a key ingredient to the country’s clean energy technology, national security, and economic prosperity!

The U.S. has NEVER had to rely on China for an energy resource before…

It’s also critical to factor in, current production methods won’t solve this lithium problem.

So let’s investigate here!

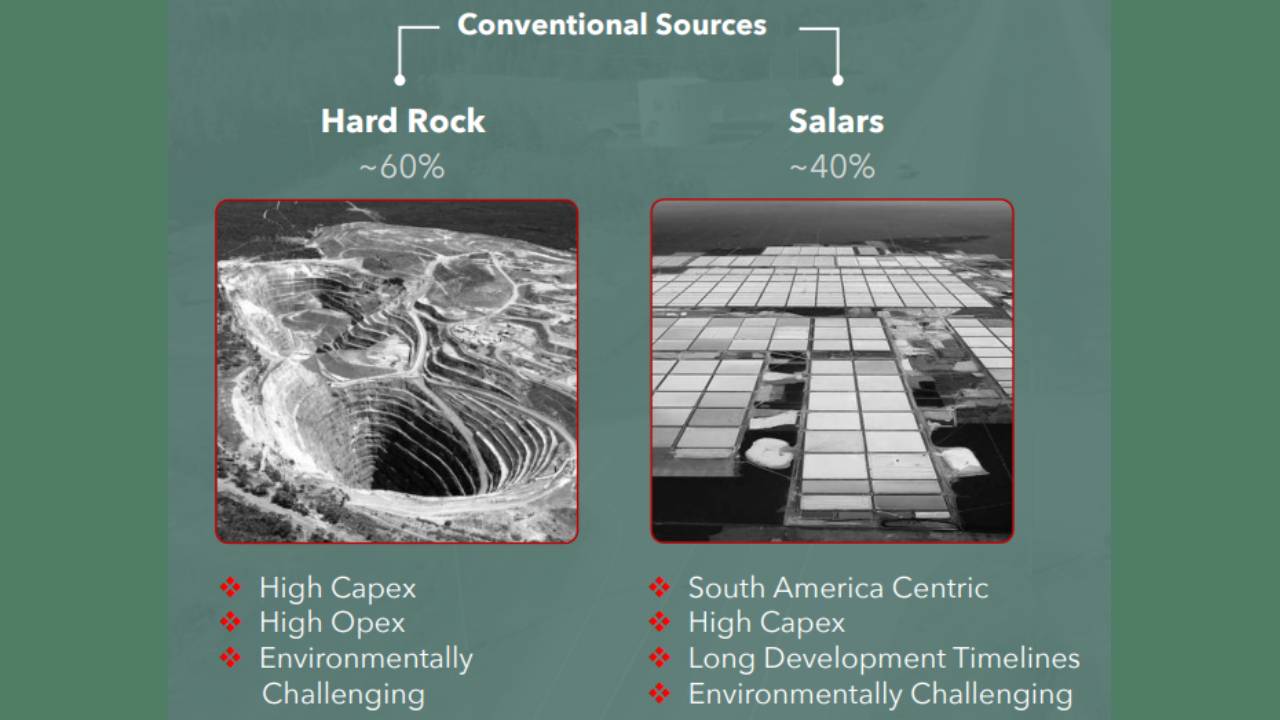

How is lithium found and mined?

Have you ever seen those vast ponds or massive quarries with gigantic dump trucks?

That’s how lithium is currently found. It’s evaporation ponds or hard rock mining, in short. Not very sexy at all for possible investors. Especially when taking into consideration the following factors:

Hard rock mines take on average, 16.5 years to develop, and recovery is a lengthy process that can take several months to a few years to complete.

Not only that, but salars are weather dependent and require large amounts of land and fresh water, and are not ecologically friendly.

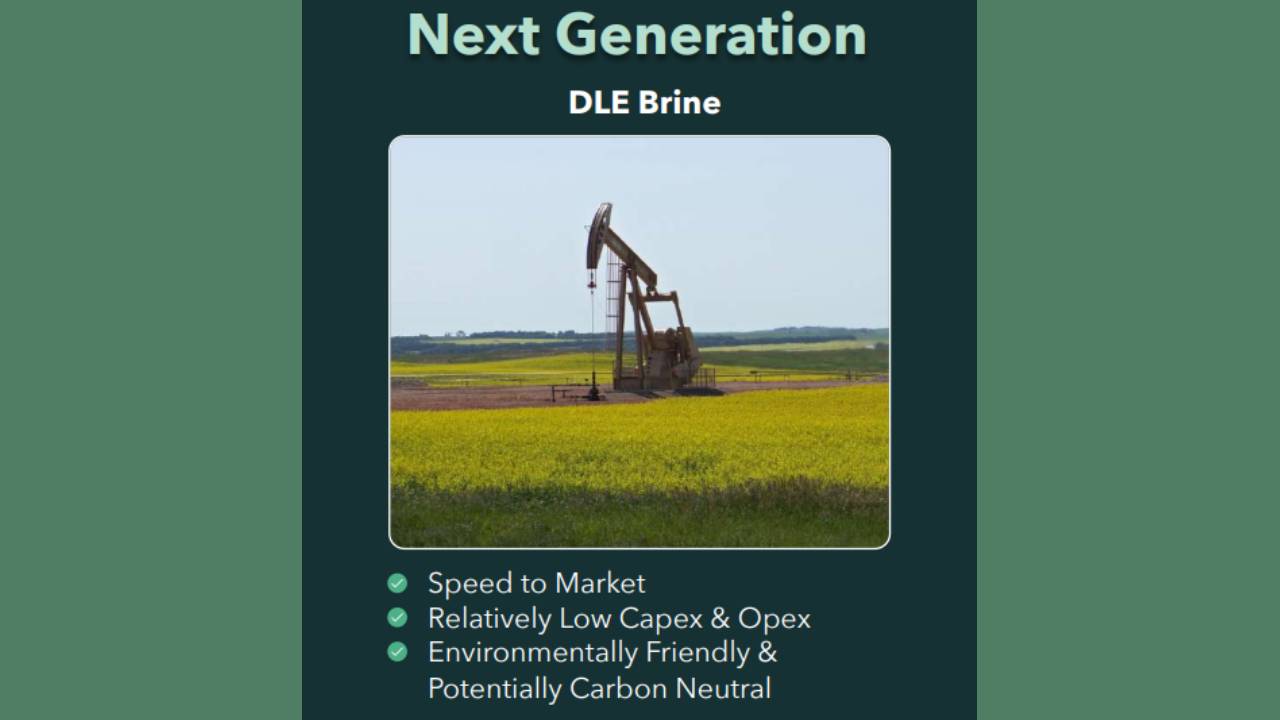

Direct Lithium Extraction DLE is the next-generation technology for the lithium supply chain.

Does this look familiar?

Kind of looks like something you would see in an oil field, doesn’t it?

As a matter of fact, U. S. Energy Secretary Jennifer Granholm called direct lithium extraction (DLE) a “game changer.”

It is revolutionizing how lithium is produced for electric vehicle batteries.

Critically important to note, this process takes HOURS versus YEARS using rock or evaporation ponds.

Furthermore, it’s 65% cheaper than blowing up lithium rock or evaporation ponds.

This newly discovered technology can extract lithium in HOURS versus months or years with existing methods (vs. hard rock mining or evaporation ponds).

Likewise, DLE allows for lithium extraction from brine in HOURS without evaporation, resulting in no depletion from the aquifer or harm to the local environment.

What is brine and how does it relate to lithium?

Well, just what is brine you ask?

More brine is produced than oil and gas, in oil and gas production. It consists of water from the geologic formation, injection water, oil and salts.

Exhausted oil wells can produce massive amounts of brine which contain EVERYTHING in the periodic table ( which is another potential revenue opportunity for the company).

Electric submersible pumps (ESPs) take a handoff from Mother Nature’s delivery and deliver this brine to the surface and then DLE technologies concentrate the lithium and process it… think reverse osmosis that occurs every day from an at home water filtration system at scale.

Lithium is the “new oil.“

Here’s why lithium is “the NEW oil,” and LithiumBank is in the catbird seat!

There are literally hundreds of exhausted oil wells filled with brine that have the potential to be REPURPOSED to produce lithium at Boardwalk.

These EXISTING wells are positioned near railroads, 4 lane divided highways… and the towns are filled with engineers/geologists specializing in resource extraction industries.

Correspondingly, DECADES of seismic studies HAVE ALREADY been performed on these wells, and the amount of lithium can be determined BEFORE drilling on a property, as opposed to drilling a NEW WELL… which can cost more than $2M and be a complete bust.

Here’s the REAL KICKER

The quality of lithium from this extraction method has the potential to be more than 93%, versus 40% from rock mining.

Not only is it FASTER and CHEAPER, but it’s also ECOLOGICALLY FRIENDLY as well!!

Now, let’s delve into this proverbial “catbird seat!” It’s EVEN MORE LUCRATIVE if a company can sell the rights from a PROVEN PROJECT to a Lithium production company.

DLE is to the lithium industry what horizontal fracking was for the oil industry… BUT BETTER for the environment!

Horizontal fracking allowed for UN-economic oil & gas deposits to be accessed economically. Comparatively, DLE could provide for economical lithium extraction leveraging PRE-EXISTING oil wells.

The so-called “waste” from Big Oil is delivering… Big Lithium!

See where this is going?

The amount of lithium can be gauged from previous oil well sample data, along with potentially leverageable infrastructure already in place to produce and ship it.

Not only that, but sampling a producing well or re-entering a previous producing well costs a fraction of drilling a new well at over $2M!

AND, the extraction process takes hours, versus months or years.

A no-brainer if there ever was one.

So, wouldn’t it make sense to acquire the lithium rights on one of the most valuable oil properties in the World?

Let’s investigate further.

Western Canada is being called the “Saudi Arabia of Lithium“

The Leduc Formation in Western Canada was “discovered” in 1940, and since then, there have been countless seismic studies on the property/wells that determined the amount of oil/gas.

It could be viewed as one of the greatest economic events to ever happen in Canada.

Literally overnight, 100’s of new oil companies were formed. This ushered in a new era in the Canadian petroleum industry at that time.

It also placed Western Canada on the world map and at the forefront of North American oil production.

Imperial Oil rose as Ultra Success Version 1.0 from these developments!

How Lithium Bank built its lithium resource business.

Could tiny heretofore undiscovered LithiumBank become the new Ultra Success Version 2.0 out of Western Canada?

Let’s dive in a little further.

Considering there are OVER 500 wells drilled in that one field… AND they now sit shut in and non producing… AND an access point to what? Well, you guessed it, lithium BRINE!

With that as a backdrop, now we can discuss LithiumBank’s visionary move regarding the Leduc Formation!

Until a few years ago, the price and demand for Lithium was nonexistent, but the LB management team knew the Electric Vehicle (EV) boom was coming and the resulting demand for lithium was inevitable.

Well, during the period 2019 – 2021, lithium prices plummeted.

As a result, many junior lithium companies that previously acquired the best claims in Alberta relinquished their claims to chase the next bouncing ball to explore for gold that was marching towards $2,000/oz, and other hopefully more lucrative resources.

The problem with this strategy is one of agony for them, and ecstasy for LithiumBank! Agony, in that all these junior lithium miners, would have to RETURN THEIR CLAIMS if they were unable to complete the work required (part of their lease agreements).

Ecstasy for LB management, as they had the visionary foresight to raise sufficient capital at the time to purchase highly sought-after contiguous claims on the now abandoned Leduc Formations that were returned.

Visionary foresight enough to invest in the seismic studies necessary to identify the most attractive confined Leduc brine assets in the province and acquire those claims … lock, stock and barrel… an amazing total of over 4 MILLION ACRES of lithium claims.

As previously stated, these are the metallic industrial minerals rights to several properties on the prolific Leduc Formation, one of Canada’s largest and most profitable oil/gas horizons.

Let’s extrapolate this another way.

LithiumBank did the exploration on over 4 million acres and is now developing over 2.5M acres in 3 district scale assets comprised of:

- Boardwalk (AB)

- Park Place (AB)

- Saskatchewan Assets (Kindersley, South and Estevan).

LithiumBank’s current district scale development land package spans a total area of ~1 MM hectares (~2.5M acres) with defined resources of more than ~6.2 MM tons LCE on Boardwalk alone which represents ~25% of the total developmental land package of LithiumBank!

Suffice to say, Boardwalk’s claims are filled with Shut-In oil and gas wells, but still have the necessary infrastructure (railways, highways, engineers, etc…).

LithiumBank‘s mineral titles are strategically positioned over known reservoirs that provide a unique combination of scale, grade and exceptional flow rates that are necessary for large-scale direct brine lithium production. With that, the hits just keep on coming.

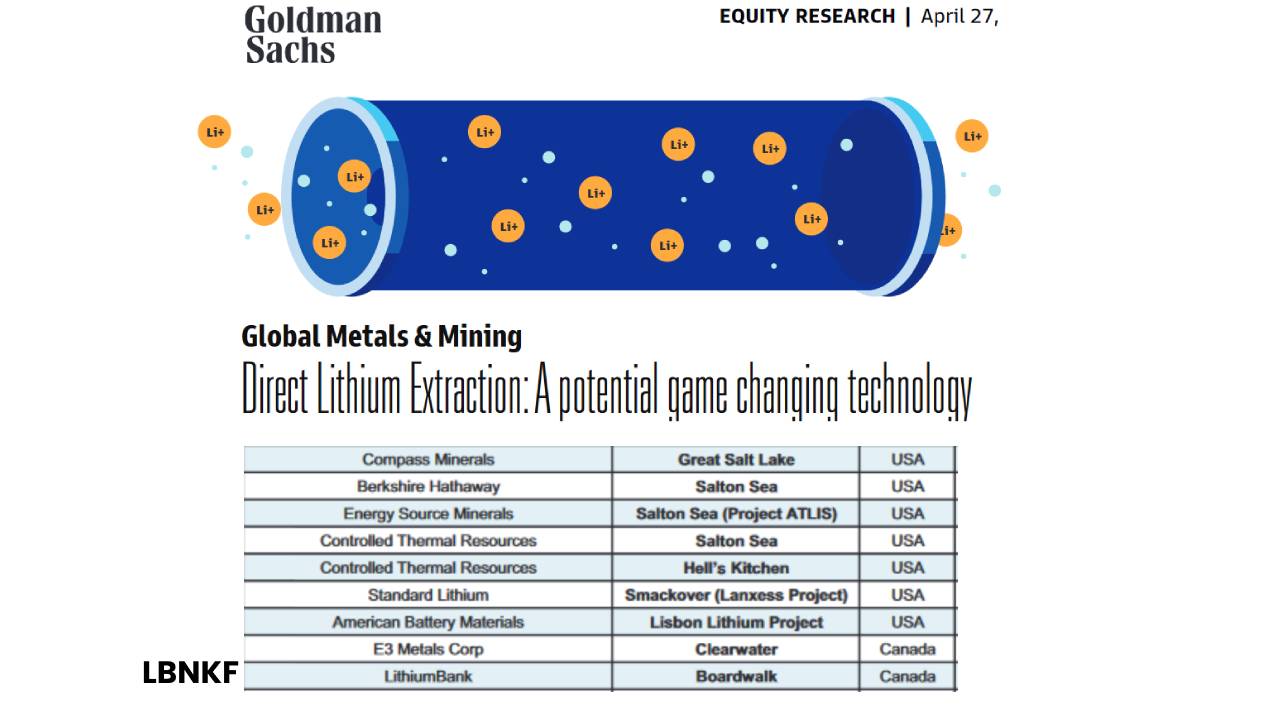

In their recent report, Goldman Sachs calls DLE a “game-changing technology” and identified LithiumBank and JUST ONE of its projects.

Read Goldman Sach’s DLE Technology Report

Lithium Bank could have 100K tons of lithium carbonate equivalent PER YEAR

The story gets even better.

First, they outlined Five or more potentially marketable development projects.

They envision these 5 projects could have potential to average greater than 20K tons of lithium carbonate equivalent per year, with Pre-Tax NPV (net present value) that could be greater than $2B NPV per project… OR total over $10B NPV!

Additionally, they have noted in their PEA that investors may soon see a resource from their Park Place asset where they have previously announced a hydrogeological study that reported the largest lithium-rich brine project, by volume, in North America!

Coupled with this initial PEA, it will also become crystal clear there could be potential for FOUR or more additional PEA able projects going forward that have potential to check the box at an average of +$2B NPV.

Unless, of course, some Mining/Lithium juggernaut snaps them up before they become even MORE valuable!

What is a PEA or Preliminary Economic Assessment?

OK, readers might be asking about now, just what is a PEA?

For those new to the mining/resources industry, a PEA or Preliminary Economic Assessment is a study that includes an economic analysis of the potential viability of mineral resources taken at an early stage of the project prior to the completion of a preliminary feasibility study.

They are also commonly referred to as a “scoping study.”

When a company announces a PEA (depending on the findings and results), it can IMMEDIATELY start an upward trend in price that can result in a substantial increase in the company’s market cap.

KEY POINT: LithiumBank’s direct comparables had less than a $50M valuation prior to releasing a PEA and traded to a range from more than $200M to over $2B in the months thereafter.

PEAs will generally include information on how much money it will take to bring the project into production, how the mine will operate once it is built, and how much metal (and money) it will produce.

It basically gives an estimate of “what the magnitude could be.”

Oftentimes, a PEA is enough of an indicator to market the sale of a project to a major.

When this occurs, the typical selling price for a PEA level project is .20 – .40 of the pre-tax net present value (NPV).

At this juncture, maybe readers and potential investors are thinking what we are?

With LithiumBank’s premier package of land rights, they could have FIVE OR MORE PEA’s over the next year… AND YES, THAT’s an unheard-of figure for one company in the mining/resource industry!

Let’s now approach this amazing undiscovered story and equation from another underlying angle.

Inflation Reduction Act… why Electric Vehicles (EV) are in great demand

In August 2022, the Inflation Reduction Act triggered the demand for electric vehicles AND North American lithium.

A very important part of the Act consisted of a $7,500 tax credit. Why was this credit so important?

Well, it translated to being worth BILLIONS of Dollars to consumers, businesses and even countries alike, by applying to electric vehicles that meet certain strict criteria.

Digging a little deeper, eligibility is contingent on 40 percent of an EV’s battery components (by value) being extracted OR processed in the United States OR in one of 20 free-trade partner nations.

This requirement begins in 2024 and gradually ratchets up to 80 percent in 2027.

The United States alone will need 500,000 metric tons per year of unrefined lithium by 2034 to power EVs, but it currently accounts for only 1 percent of global lithium production.

Needless to say when factoring in all the above, that’s why you’re seeing unprecedented merger and acquisition activity the last few weeks.

Livent is merging with Allkem, and Albermarle is trying to acquire Liontown Resources.

Coupled with the CEO of Albermarle buying 5,470 shares in the open market worth roughly $1M.

Canada is ADDING to the U.S. Inflation Reduction Act EV Incentives

The Canadian Budget for 2023 signals a clear intent by their federal government to enable the establishment of a world-class Canadian EV and battery ecosystem.

By the same token, Ford and Volkswagen wasted no time and are already building EV and battery plants in Canada.

Is Paul Matysek the Greatest Resource Entrepreneur of all time?

Well, there might be some argument on that question, but Warren Buffet would have to be considered at the top from an American perspective with all his natural gas and petroleum successes over the years.

Of course, from the Canadian perspective, no list of successful resource investors could omit one Eric Sprott. He of all the successful gold, silver and numerous other resource plays over the decades.

We say all of that to say this: readers just might want to consider Paul Matysek as an up and comer that might one day be mentioned in the same breath as Mr. Buffet and Mr. Sprott, especially if he continues his impressive track record to date!

LithiumBank just named Mr. Matysek (also the largest shareholder) as its Executive Chairman. He’s a mining industry veteran who has a PROVEN track record of selling PEA level projects to the majors.

So far, he’s already sold SIX publicly listed exploration and development companies worth over $2.0B.

As a matter of fact, his last lithium brine venture (Lithium X Energy) started trading on the OTCQX December 2016. By December 2017, the company was acquired for over 500% from the price it started trading.

On May 1, following their strategic naming of Mr. Matysek (in our opinion), the company appointed a resource merger and acquisition specialist!

Katya Zotova was named to the BOD of the Company.

She previously acted as a Senior Advisor on M&A and Private Equity for McKinsey & Company.

Prior to McKinsey, Ms. Zotova led direct investments at L1 Energy / Pamplona Capital LLP, and ran the International Acquisitions and Divestments group for Energy Investment Banking at Citigroup, along with holding a number of strategy and M&A roles at Shell plc.

It doesn’t take a rocket scientist to read the tea leaves here folks! Again though, all in our opinion!

Then on May 15, the company announced a Bought Deal private placement of CDN$ 6,900,230.

Not to mention here, LithiumBank may also acquire adjacent properties to enhance their resource base.

In other words, MORE PEA level project potential, AND/OR ONE-TIME spinoffs or dividends.

Lithium Bank is an INCUBATOR of lithium properties

Can you see their business model and why they call the company Lithium BANK?

This is, in the truest sense of the word, an Incubator of lithium properties!

In coming down the home stretch of this report, by the end of 2023, the company expects to be THE ONLY lithium DEVELOPMENT company with MULTIPLE PEAs and Pilot Plant Studies commenced on MULTIPLE district-scale projects.

What could LBNKF be worth?

Again, this begs the question, just WHAT could this company be worth?

For the sake of total comprehensiveness, let’s do some back-of-the-envelope math once AGAIN here.

Understanding that, we see the demand for lithium only increasing.

Additionally, a company with potentially FIVE or more PEA-level projects, with the potential to average more than 20K tons of lithium carbonate equivalent per year and a Pre-Tax NPV that could be greater than $2B on average per project.

At least FIVE projects assuming an average pre-tax NPV of $2B would equal $10B NPV.

Now, knowing that PEA projects are usually sold between .20 – .40 of NPV, this sets the stage for blue-sky potential over time of value creation of +$2B.

For argument’s sake, let’s discount that figure by 50%. It STILL equates to $1B! When factoring in the company’s fully diluted share count totalling roughly 46M shares and if we assume another 6M shares of dilution to produce the PEA’s and pilot plants planned as of May 1, 2023, that tallies up to a price range with potential for +$20 per share.

Again, knowing that Paul Matysek has a history of selling PEA-level projects, AND the company just added ANOTHER M&A expert, AND the company just announced its FIRST PEA (Boardwalk) with a US$2.7B NPV… AND at least 1 more PEA projected to release by the end of the year, the ANDS have it hands down!

As each PEA gets announced, and remembering they have potential for FIVE or more, the value of the company has great potential to increase by orders of magnitude.

On the flip side, it’s certainly not a stretch to think that if the company sells the first PEA project, a major might see the value in buying the company BEFORE the OTHER 4 are announced!

Indeed, LARGE players in the lithium world might want to acquire the company BEFORE the announcement of Four OR MORE PEAs.

Can you say, “catbird’s seat?”!

BREAKING… (DLE News since the report was written)

Exxon Mobil paid $100 million to buy the rights for a 120,000-acre tract known to be brine rich in lithium, validating the potential of DLE technology.

Ford signs deal with Compass Energy for lithium brine project

RISKS.

Working capital. A typical PEA costs approximately $500K and there are additional costs associated with EACH project.

Inflation Reduction Act. If the incentives are reduced or eliminated by the U.S. Government, there could be a significant reduction in the demand for electric vehicles.

Competition. There are new battery technologies claiming to be cheaper and offer longer and lighter batteries. This is a very new and large market. Fully expect to see new technologies enter the space.

Canadian Government. For now, our neighbors to the Great White North seem very friendly to this emerging industry. New regulations or fees could have a significant impact on their business.

Artificial Intelligence Stock Reading

- The Best Artificial Intelligence Penny Stock VERSES AI

- Artificial Intelligence Stock with BIGGEST Potential

- Best Artificial Intelligence Stock Under $10

- What is BETTER than ChatGPT Generative Artificial Intelligence

- Generative Artificial Intelligence Regulation Solution

- How To Govern and Regulate Artificial Intelligence

- The BEST C3 AI Stock Alternative

- Next Generation Intelligence Patent Application

- The ONLY Adaptive Artificial Intelligence Stock

- Artificial Intelligence Stocks

- VERSES VRSSF 2023 Year End Summary

- The Story of VERSES AI VRSSF

- How VERSES AI Solves the Generative AI Problem

Bottom Line

Our digital marketing agency believes that creative content is better than spending money on ads.

Disclaimer.

This service is published as an information service for highly speculative investors, and it includes opinions on buying, selling, and holding various stocks and other securities. Lithium Bank Resource is an extremely high-risk investment, and it is HIGHLY LIKELY you can LOSE YOUR ENTIRE INVESTMENT.

Investors should consult with their financial advisor BEFORE making ANY investment.

Prospective investors should carefully consider and evaluate all risks and uncertainties involved in an investment in this Company, including risks related to the Company’s limited operating history, the Company’s need for additional funding, the Company’s ability to successfully implement its growth strategy, conflicts of interest, the uncertainty of the use of available funds, the Company’s failure to manage growth, and reliance on strategic partnerships.

The information provided is obtained from sources believed to be reliable but is not guaranteed for accuracy or completeness. Any persons who buy, sell, or hold securities should do so with caution and consult with a broker or investment adviser before doing so. Any discussions and pages may contain forward-looking statements that involve risks and uncertainties. A company’s results could differ materially from those in forward-looking statements or announcements. All material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities.At various times, we may own, buy or sell the securities discussed for investment or trading purposes. We (publishers, owners, and agents) are not liable for any losses or damages, monetary or otherwise, that result from the content shared. Scott Shaffer is compensated by Lithium Bank Resource (the “Company”) for publicizing information about the Company and its products.

The payment was made through both (i) 100,000 stock options from the Company and (ii) the payment of cash compensation in the amount of $7500.00 per month for a period of 6 months starting May 2023. As of May 23, 2023, the Company had paid an aggregate of $7,500.00 in cash compensation for such services by Scott Shaffer. Additional cash payments may have accrued since then.

Real Creative Agency

Digital Marketing Experts

Daily helping our most valuable asset "YOU" since 2005.