Published: September 8, 2023 | Published By: Real Creative Agency

Which Lithium Stock, EEMMF or LBNKF has a BIGGER Upside?

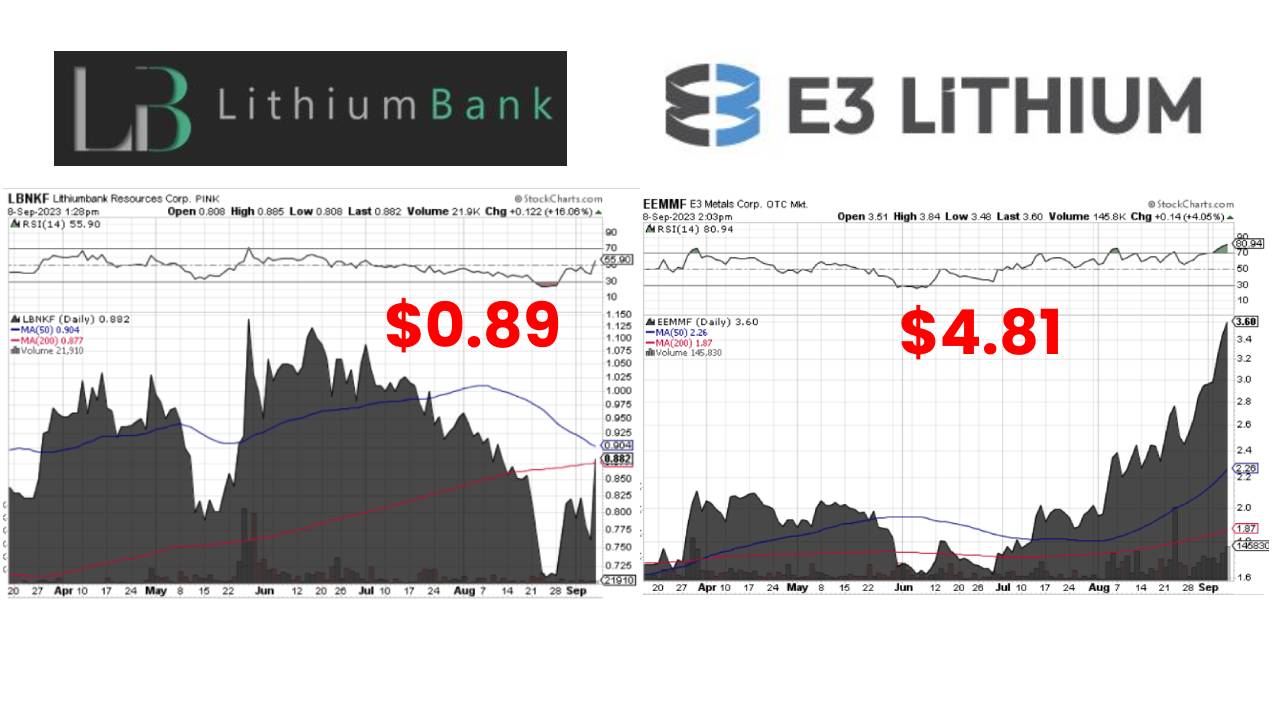

E3 Lithium (EEMMF) recently announced Alberta’s first direct lithium extraction pilot plant and its stock has been making 52-week highs daily.

Is Lithium Bank worth MORE than E3 Lithium?

But does Lithium Bank (LBNKF) have an ever bigger upside?

Let’s investigate!

Both companies are players in the direct lithium extraction space in Western Canada and have formed partnerships with leading oil companies.

DLE Direct Lithium Extraction is a breakthrough technology that offers “instant lithium” and has previously been a speculation play, up until now, that is!

Last week, EEMMF announced the commencement of operation of its Direct Lithium Extraction (DLE) pilot plant at its Clearwater project. E3’s plant represents the first commercial operation of a pilot plant within the Western Canadian Sedimentary Basin (“WCSB”).

EEMMF’s success is validating the DLE technology.

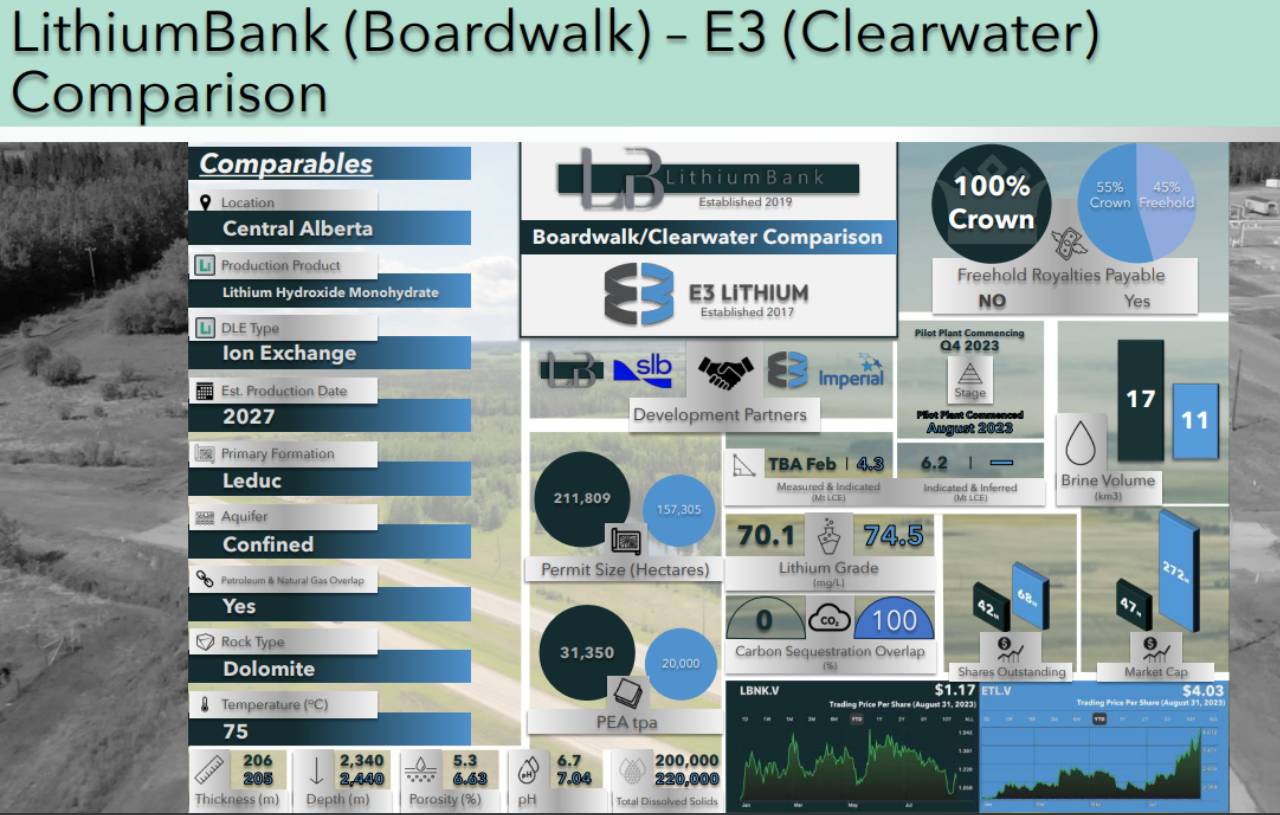

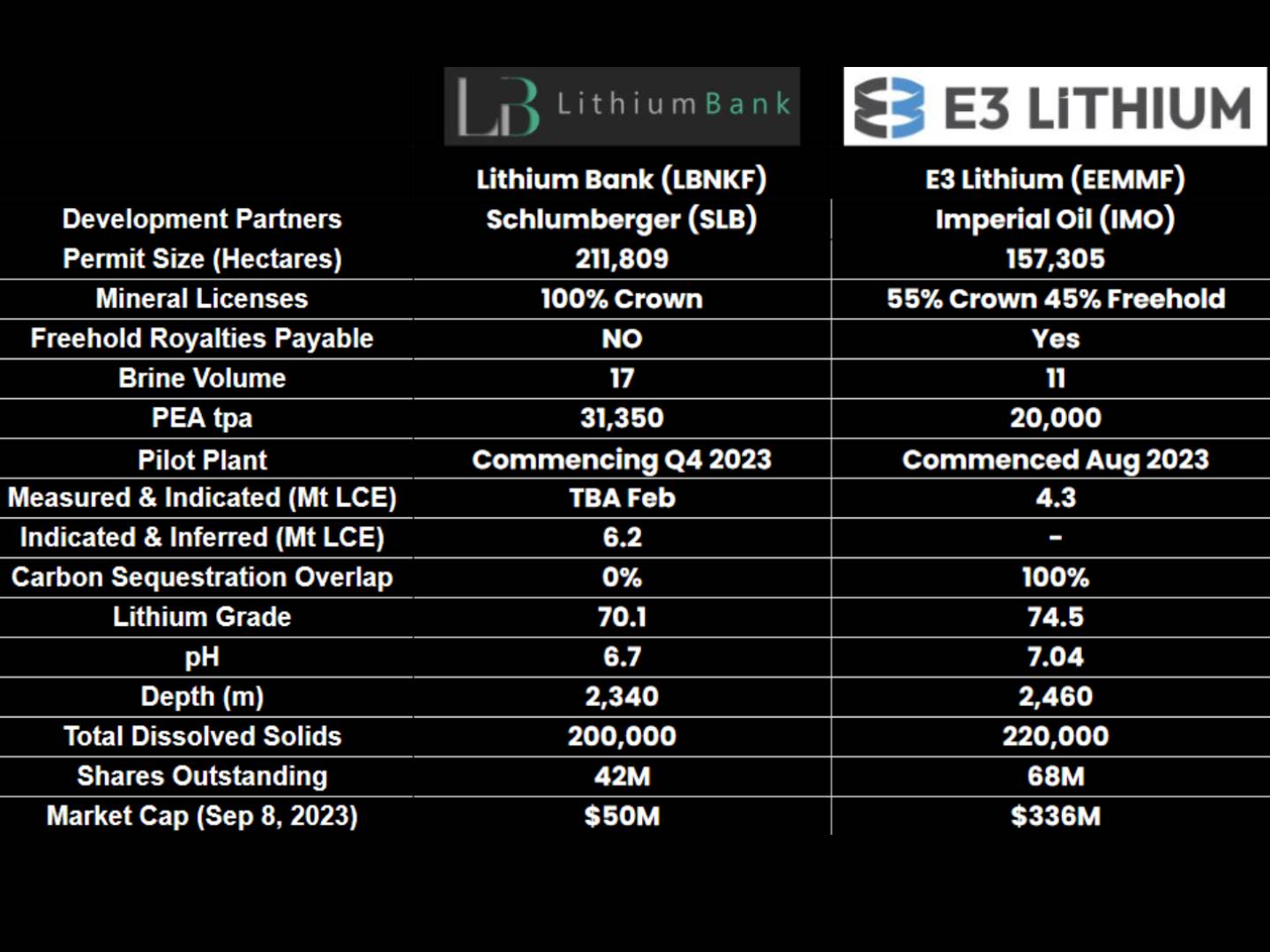

And while EEMMF is making new highs and trading at over $300M market cap, let’s look at the comps between their respective PEA’d projects EEMMF (Clearwater) and LBNKF (Boardwalk).

Once investors are tuned in and compare the metrics between the two, it becomes a no-brainer for potential investment.

Keep in mind this plant is less than 150 miles southeast of Lithium Bank’s (LBNKF) properties on the Leduc and Swan Hills Formations, which have historically been known to host some of the highest grades of lithium-in-brine native to Alberta as well.

Ah, but there’s more… MUCH more when investigating this story more closely.

As a matter of fact, LBNKF has more than TWICE the cubic kms of brine of EEMMF, and it’s trading at almost ONE-SIXTH of the market cap, for now.

Drilling down just a bit further (pardon the pun), let’s look at those metrics:

- Same aquifer, ie., Leduc Formation

- Same age at 400M years old, nearly identical brine depth, grades, temps, pH and chemistry, roughly 150 miles apart in Central Alberta

The company just engaged SLB Schlumberger Ltd., the world’s largest drilling company by size and revenue!

This giant resource company is to provide an upcoming resource estimation and preliminary economic assessment (PEA)

As a matter of fact, the results of SLB’s work are expected in 90 days.

This would be the 2nd PEA after the PEA of Boardwalk announced (USD $2.7 Billion NPV and Annual EBITDA of US $586M for a 20-year period.

In addition, possible Boardwalk PEA Enhancements could boost the NPV to over U.S. $3B, and the Annual EBITDA could easily exceed U.S. $650M.

Not to mention here, the Park Place Project’s initial sampling results have proven to be BETTER than Boardwalk, and the hydrogeological study showed 76 cubic kms of brine vs. 17 at Boardwalk!

But, if we took the SAME comps from Boardwalk, Park Place could achieve a multiple of the Boardwalk NPV, and Annual EBITDA.

When combined, that could mean Boardwalk and Park Place together, might potentially generate over U. S. $2B EBITDA annually.

We would also be remiss here if we did not mention, EEMMF has 68M shares outstanding, whereas LBNKF has approximately only 42M shares outstanding.

But there’s even more to the story!

LithiumBank has positioned itself to be the next battery-grade lithium producer.

According to Natural Resources Canada, the country currently has an estimated 3.2 M tons of Measured & Inferred lithium resources located in hard rock deposits.

Lithium Bank holds almost double that amount with 6.2M tons LCE.

We know from their PEA, 31,350 LHM, or “battery-grade lithium,” is possible from Boardwalk South and we know there is space and brine to potentially do another 30k LHM project in Boardwalk North, which are very attractive investment options.

What does that mean? Simply a lot of Battery-grade lithium!

Additionally, the company expects increasing confidence in the resource estimate to Measured & Indicated (M&I), becoming even more valuable to buyers, as will the piloting and showing proof of concept.

But one thing that most people overlook is the mineral tenure.

Boardwalk and Park Place are 100% crown mineral licenses.

The benefits of obtaining a crown mineral license include the right to explore, mine or extract minerals that are owned by the government.

They have NO competition with other mineral holders on adjacent freehold land and are only liable for crown taxes and royalties.

Being in Alberta, allows for options when optimizing the barren brine (provincial regulation allows for reinjection into any formation) and most importantly, a permitting road map to production that is likely only 2 years.

Permitting includes many things such as water, power, land usage and environmental advantages.

Summary of Saskatchewan Sale Projects

Please see our full summary of the Saskatchewan.

LBNKF has a VERY ATTRACTIVE and COMPELLING investment model, being the ONLY lithium incubator!

With this in mind, the goal is to monetize EACH one of its potentially as many as 6 projects and flow the value through to shareholders in the form of dividends or shares in a new company.

KEY POINT:

Saskatchewan was never part of their multi project incubator strategy.

On the contrary, Saskatchewan is not a significant monetary sale. They have enough paid-in capital to date, that they will pay very little tax on this transaction, so no need to sell the company to do this.

It’s expected that the company will use/repurpose this cash to develop Boardwalk and Park Place, as it’s cash they’re just getting back that was spent on the Saskatchewan projects.

The shares of Pristine will be held by the company and on their balance sheet. Comparatively, this arrangement is just like every Tesla sold is for Tesla shareholders, if a Tesla were sold for cash and stock.

To sell the Boardwalk projects (2) OR Park Place Projects (4), they would have to sell the whole company and spin out the rest to newco with the same shareholder ownership for tax reasons, ie., minimize the substantial tax that would be paid otherwise.

We recently asked the company:

You announced the initial PEA for Boardwalk … what step(s) come next on the part of LithiumBank before the company can realistically sell the project.

How long – a range — should it/they take?

“We expect to upgrade the Boardwalk PEA and then drill to upgrade resources to Measured and Indicated, and in parallel operationalize our Pilot plant (for all of our Alberta projects) by the end of the year… open season thereafter.”

Lithium Bank LBNKF Summary:

Big Oil is venturing into lithium brine in North America, and E3 Lithium just validated both the DLE process AND the rich combination of concentration and deliverability in Alberta.

- LBNKF just engaged SLB (formerly known as Schlumberger) for a PEA on the Park Place Project.

- LBNKF has over TWICE the cubic km’s of brine of EEMMF, and it’s trading at almost ONE SIXTH of the market cap, for now

- LBNKF’s business model is to spin off their projects as either one-time dividends, or shares in a new company. This equates to multiple ways of winning for investors. Essentially putting them in the catbird’s seat, with exceptionally better odds than, say, chancing a lottery ticket. AND with a MUCH quicker and cheaper return!

Decidedly so, considering an expected return on investment, versus going into production like EEMMF’s strategy. For potential investors, the deck is stacked in Lithium Bank’s favor here in our view!

When taking all the above into consideration, we feel LBNKF is a much better investment!

Artificial Intelligence Stock Reading

- The Best Artificial Intelligence Penny Stock VERSES AI

- Artificial Intelligence Stock with BIGGEST Potential

- Best Artificial Intelligence Stock Under $10

- What is BETTER than ChatGPT Generative Artificial Intelligence

- Generative Artificial Intelligence Regulation Solution

- How To Govern and Regulate Artificial Intelligence

- The BEST C3 AI Stock Alternative

- Next Generation Intelligence Patent Application

- The ONLY Adaptive Artificial Intelligence Stock

- Artificial Intelligence Stocks

- VERSES VRSSF 2023 Year End Summary

- The Story of VERSES AI VRSSF

- How VERSES AI Solves the Generative AI Problem

Bottom Line

Our nanocap marketing agency believes that creative content is better than spending money on ads.

Disclaimer.

This service is published as an information service for highly speculative investors, and it includes opinions on buying, selling, and holding various stocks and other securities. Lithium Bank Resource is an extremely high-risk investment, and it is HIGHLY LIKELY you can LOSE YOUR ENTIRE INVESTMENT.

Investors should consult with their financial advisor BEFORE making ANY investment.

Prospective investors should carefully consider and evaluate all risks and uncertainties involved in an investment in this Company, including risks related to the Company’s limited operating history, the Company’s need for additional funding, the Company’s ability to successfully implement its growth strategy, conflicts of interest, the uncertainty of the use of available funds, the Company’s failure to manage growth, and reliance on strategic partnerships.

The information provided is obtained from sources believed to be reliable but is not guaranteed for accuracy or completeness. Any persons who buy, sell, or hold securities should do so with caution and consult with a broker or investment adviser before doing so. Any discussions and pages may contain forward-looking statements that involve risks and uncertainties. A company’s results could differ materially from those in forward-looking statements or announcements. All material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities.At various times, we may own, buy or sell the securities discussed for investment or trading purposes. We (publishers, owners, and agents) are not liable for any losses or damages, monetary or otherwise, that result from the content shared. Scott Shaffer is compensated by Lithium Bank Resource (the “Company”) for publicizing information about the Company and its products.

The payment was made through both (i) 100,000 stock options from the Company and (ii) the payment of cash compensation in the amount of $7500.00 per month for a period of 6 months starting May 2023. As of May 23, 2023, the Company had paid an aggregate of $7,500.00 in cash compensation for such services by Scott Shaffer. Additional cash payments may have accrued since then.

Real Creative Agency

Digital Marketing Experts

Daily helping our most valuable asset "YOU" since 2005.