Published: August 16, 2023| Published By: Real Creative Agency

The Solution to the Generative AI Problem

The generative artificial intelligence industry is growing rapidly but now faces a big problem. Is this the solution?

- Generative ai providers started facing regulations

- AI venture funding collapsed

- World’s largest law firm offers ai governance report

- IEEE may offer ai standards

- AI pure play could save generative ai

A LOT has happened with both the generative ai industry and VERSES AI in just the last 60 days.

We had the recent privilege to be part of a talk with the CEO of VERSES AI Gabriel Rene.

* VERSES AI trades on the OTCQX under the symbol VRSSF

The Spatial Web book outlined the idea of how two emerging technology trends were converging… AI, and when the physical world connects to the Web that will use AI.

Writing it and being the visionaries they are, management recognized well before everyone else, that this reality will need standards!

Like we have for electricity, telecommunications and internet etc…, to ensure drones and cars don’t run amok.

The world’s biggest safety issue has just changed.

In the most recent 6 months, the world’s biggest safety issue went from climate change to AI governance.

The basis of regulating AI has always been part of our plan… it’s been about creating standards for AI governance, so machines using AI don’t go “Terminator” on society.

Case in point here, standards are more powerful than laws, because laws are built on top of standards.

We’ve been building possible revenue-generating applications (Wayfinder, Datalens) while proving the standards.

VERSES’ Flying Forward Project isn’t about AI powered drones .

It’s translating the laws of 5 different countries into a standard that AI could understand, and be forced to comply with. Simply put, format data that AI can understand, and then govern it!

VERSES AI is validating this with a drone, but it could be done with any “machine” (server, chip, drone and car etc…)

THIS is why the Dentons Report is so critically important!

(Please see The Future of Global AI Governance)

By the same token, this strategic collaboration is getting the attention of many companies and governments, because it’s absolutely vital to AI governance moving forward.

Not to mention, what better group to work with jointly together, than universally respected Dentons. They provide a veritable plethora of international connections, including governments and politicians!

To this end, the company presented at the autonomous vehicle conference last year, educating attendees on how they were translating laws into data that AI could understand.

Important to note, the head of the autonomous vehicle group at Dentons, whose clients include BMW, Waymo (and many other autonomous vehicle players), was also in attendance.

So who or what is Dentons?

They are the world’s largest law firm, hired to consult with regulators, governments and manufacturers. And YES, they are now pointing to VERSES’ solution as the basis for ALL future laws that are drafted for ALL AI-powered anything.

This is truly significant and a noteworthy milestone for the company.

Consider this, VERSES AI could be the only place to build or test, whether AI solutions are compliant or not.

If you read The Spatial Web, readers also know that Deloitte’s article “The Next Era of Computing” raised awareness for the company and attracted A LOT of FORTUNE 500 companies.

How do we know this?

Because several resulting pilot projects ensued.

In that regard, the Dentons Report is doing the same thing with major companies AND governments, for an AI solution that is explainable and auditable!

Just like the company’s association with the IEEE gives credibility to the standards side, now their alliance with DENTONS gives important validity to the regulation side.

Although this is true, Dentons had been translating the laws of every street in the world into something AI engineers could understand how to program and develop their AI models with, and were failing miserably!

On a granular level, they were looking for a scalable way of translating human laws into something machines can understand.

Enter VERSES AI.

As previously alluded to, the company presented at the autonomous vehicle show last year (demonstrating this concept with drones) and DENTONS realized how valuable this solution was to THEIR business and perhaps more importantly, the exploding AI industry unfolding.

Coupled with IEEE and DENTONS, VERSES may be cornering the basis for all laws regarding robots, cars, drones, IoT AND all AI’s that access a computer!

Furthermore, ALL future AI governance laws in the rapidly developing Web 3.0 realm could potentially be written in these standards.

So, taking all this into consideration, just how should a savvy investor evaluate this company?

How to invest in the artificial intelligence space.

You’re looking at VERSES (VRSSF) the wrong way.

Realizing, the AI market is really only 6 months old, and almost ALL of the players in it are PRE-REVENUE, smart investors need to look at their investments in AI like a Venture Capitalist!

Why? Because this is what and how they invest in emerging technology.

Because these companies are PRE-REVENUE, VC’s do NOT look at traction as the first indicator… they simply can’t!

For example, when Sequoia Capital and Kleiner Perkins invested in Google, you can bet your bottom dollar they didn’t ask, “What’s your revenue?” Because they were looking at their criteria, total story and potential.

Heck, the #1 search engine of all time hadn’t even launched yet! Similarly, the same went for Peter Thiel with Facebook.

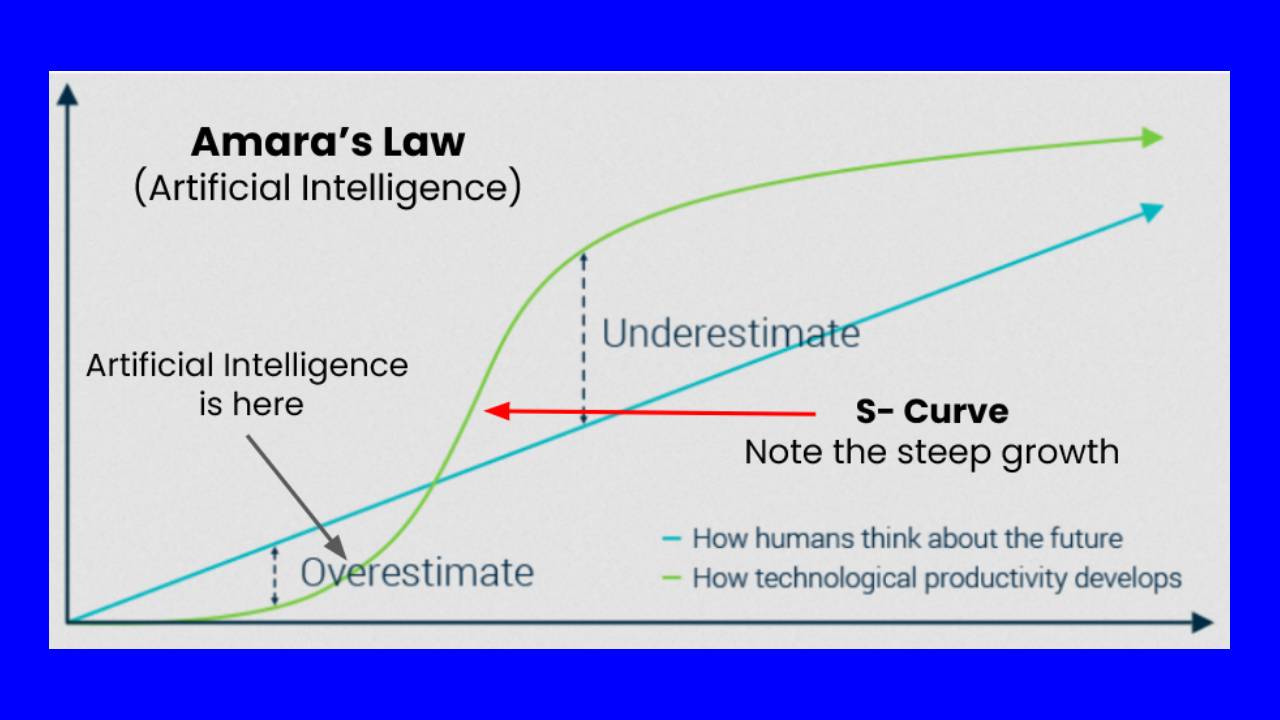

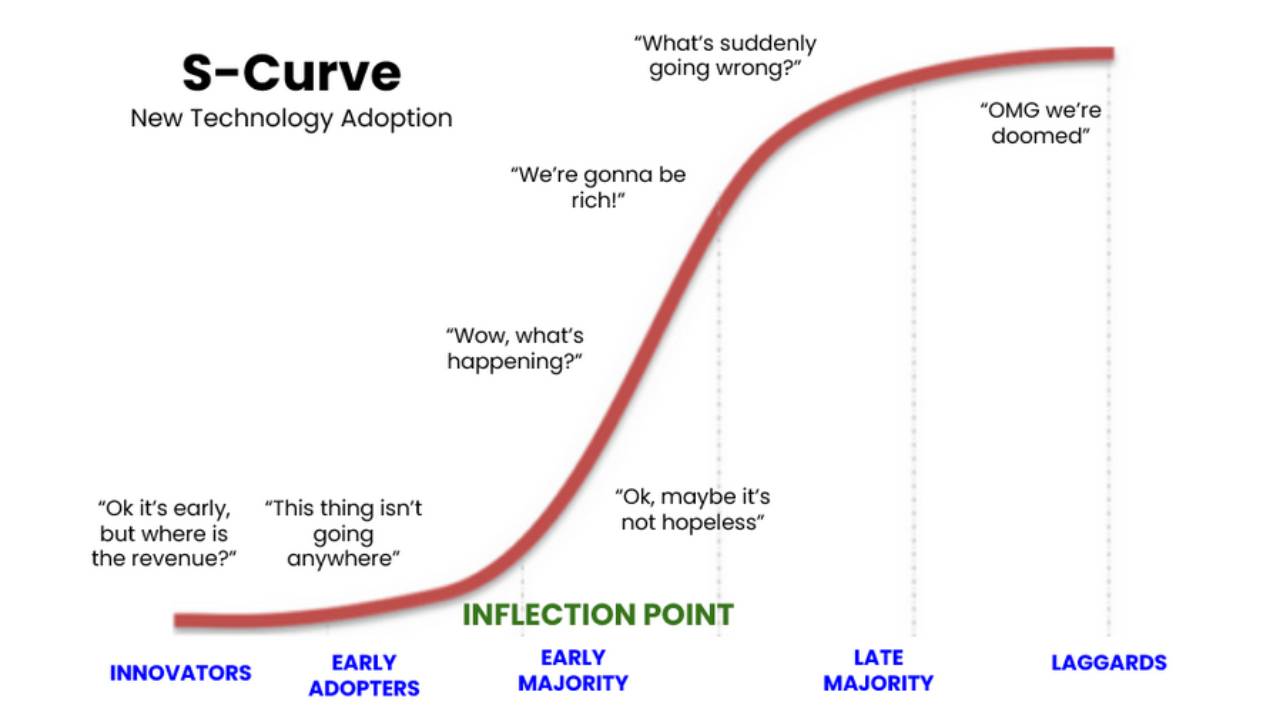

To get those 1000X returns, think like a VC and be an early investor! THEY rely on 2 very powerful principles, Amara’s Law and the S Curve (or Adoption Curve of a new idea or technology).

First, nearly three-quarters of global VC’s invested in AI over the past year, with investors identifying AI as the technology with the most disruption potential. (Source)

In early June, a Morgan Stanley analyst explained Amara’s Law with artificial intelligence.

Note: Investors are OVERESTIMATING the power of AI right now.

The S Curve explained… note how retail investors while overestimating artificial intelligence adoption, are judging the adoption by focusing on ”where’s the revenue?”

Exactly the opposite of a VC!

“Innovators” and “Early Adopters” are typically VC’s and very high risk investors in a new technology.

Here’s the truth with early stage tech investing though…

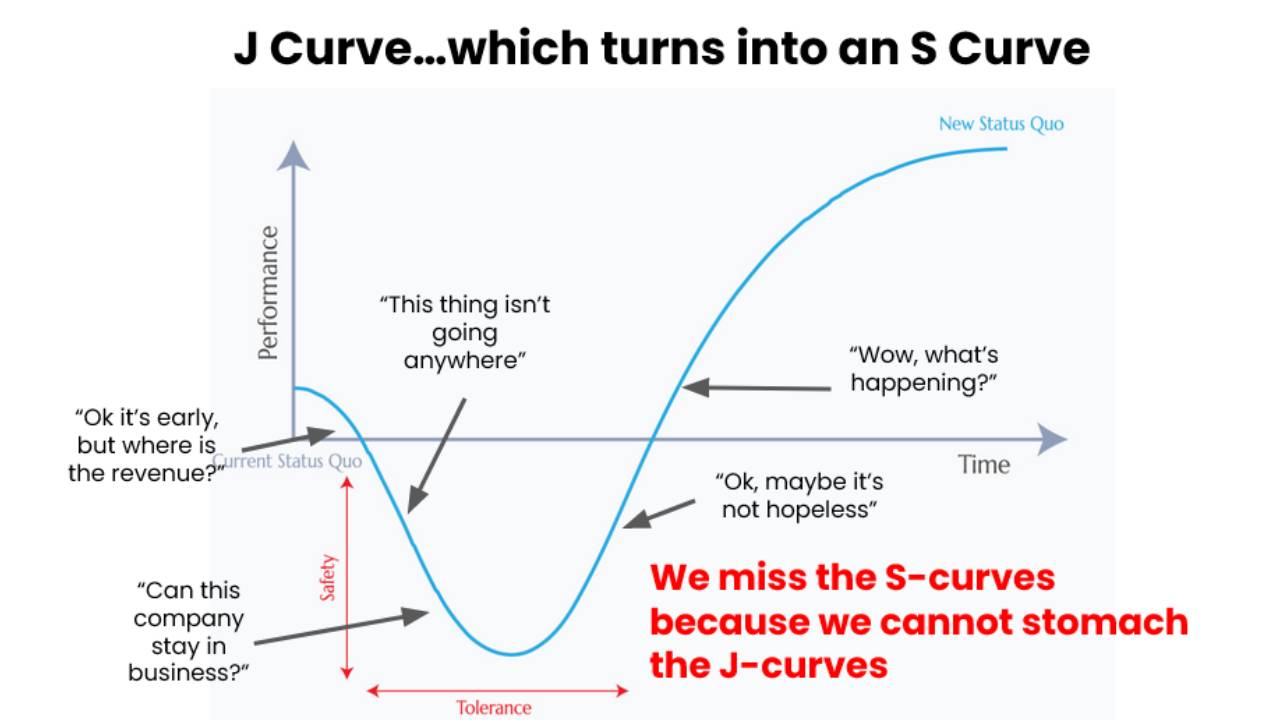

Companies typically experience a J CURVE BEFORE the S curve.

KEY POINT: Things appear to GET WORSE before they GET BETTER… capital spending (hiring, product development, marketing etc…) increases, which makes the losses seem even larger (PRE-REVENUE)

J-curves track the negative financial performance of companies as they launch themselves into the bottom half of an S curve. This performance gets a lot worse before it gets better.

Venture capital understands this. They are designed to invest in J curves and be cognizant of that reality.

VCs EXPECT this drop!!!!

So be prepared for the dip in the J Curve but also know there are MORE RISKS in early stage technology.

The risks.

On the other side of this coin, sometimes the S Curve never happens, and the company just runs out of “runway,” i.e., funding.

There are many reasons for this particular eventuality, like competition, market timing, leapfrog technology, economy, etc…

So how can an investor know IF an S Curve is coming?

Well, YOU CAN’T, but here’s a guide professional early stage tech investors often use.

A Venture Capital Investing Blueprint

1. TIMING… is it relevant to a massive market and ready to emerge? They rely on industry or economic news to determine how far from adoption. In the case of AI, NVDA (chips for AI) stated they saw incredible demand for their product, and chips relate to infrastructure.

2. TEAM… do they have experience and can they navigate the new space? (because chances are the business model WILL CHANGE several times) VERSES announced Darin Bunker (former Head of Software Engineering at Elementum) and Dr. Thiruvengada (former Director of Product Management at Honeywell) on board.

3. TECHNOLOGY… do they have something truly unique to give an unfair advantage? 2 patents filed (AI Agent Mass Production) and (Predictive Querying).

4. TRACTION… the very LAST thing they consider… when a company starts generating revenue is when they go public, and when VC’s liquidate some of their position for 500-1000X gains… THEY sell their position to YOU the retail investor!

On the flip side, retail investors do the exact opposite! The vast majority ask, ”what’s their revenue?”

Unfortunately, this is the first and foremost question.

However, as we’ve mentioned in past reports, VERSES AI provides a unique opportunity for potential VC-like returns for the savvy and patient investor that is able to evaluate and envision the total picture!

With that, let’s look at a pretender to the AI throne and compare.

ChatGPT and Generative AI providers have a BIG problem.

VERSES foresaw early on, the #1 problem companies would have with AI. Namely, if a company wanted to take their data and add AI, along with asking questions about it, they would need to store their data and format it so AI could understand and interact.

Companies need to design their data so it can be usable by AI.

In contrast, VERSES’ standards do precisely that.

VERSES AI Update.

NEW PRODUCT???????????!!!!!!

Think of this as a “ChatGPT on steroids for YOUR private data.”

The company has built a solution that designs a database for AI, and has this memory built on their standards!

They structure unstructured data and put it into the HSML format.

Drilling down even further, for this product to scale, it needed to retool the data layer! In light of this, a recently filed patent covers this certainty.

With this intention, VERSES’s AI is way ahead of the market, PLUS it’s built with the all-important standards.

In layman’s terms, it gives their AI or ANYONE else’s AI memory and reasoning, presentable in a COMPLETELY explainable and auditable way.

This unique technology has a VERY powerful capability… it’s WIDELY SCALABLE… and is expected to roll out to developers in Q4.

On the revenue front, this new product could be monetized 2 ways.

First, formatting the data for AI.

Secondly, an AGENT on top of the data (Datalens). This one-two punch is a solution that meets explainable, auditable standards and is FAST, along with being CHEAPER than any other solution on the market!

This has MASSIVE revenue potential.

Please see our FULL REPORT on VERSES AI (Google Doc)

PATENTS.

The last two patent filings, “Agent Automation” and “Predictive Querying,” are based on technical breakthroughs that the company thought about years ago before ANYBODY in the AI space.

As far as these two very important patents go, keep this in mind… Amazon’s “one click” patent may be the most valuable thing the company has ever created!

In our opinion, VERSES’ patents are in the same league!

AN ANALOGY on How To Think of AI

Now, here’s an analogy of how to think of AI.

A smart car is self-driving and has software that can drive. In stark contrast, VERSES AI’s solution is software that can think.

A world of difference when comparing the two

VERSES is building software and a platform that not only allows you to make ANYTHING “smart”, BUT beyond smart!

GENIUS is their new Trademark. “Genius for anything”.

Think drone, car, warehouse, database, sensor etc…, a PRETTY big market.

Ok, let’s finish strong down the homestretch with some recapping and further digestion of this unique investing opportunity.

As stated, VERSES is an early-stage Silicon Valley startup. But, in our opinion, it is also an “extreme outlier.”

How so, and what’s that?

Well, famous VC Marc Andreessen explains “Most VC’s are looking for extreme outliers, and when they’re evaluating your startup, they’re asking themselves if this business is one of the 15 businesses that year that will get to $100M in revenue.”

“The default way to do venture capital is to check boxes: really good founder, really good idea, really good product, really good initial customers. Check, check, check, check. ‘Ok this is reasonable, I’ll put money into it.’ But what you find with those checkbox deals is that they don’t have something that makes them really remarkable and special.

They don’t have an extreme strength that makes them an outlier.”

Again..we believe VERSES AI (VRSSF) is considered an “outlier”.

Andreessen Horowitz compares AI to Cloud Era.

One of the top VCs in Silicon Valley (Andreessen Horwitz), run by the above Marc Andreessen, put out this summary about AI. (Source)

Here are the most notable quotes.

Artificial Intelligence industry update.

Last year ChatGPT came on the scene and created an AI frenzy.

Up until just recently, NOBODY cared about regulations!!!

Now for the conundrum. Once AI kicked in, all companies looking for AI CAPABILITY, realized their LIABILITY if they didn’t have EXPLAINABILITY…say that 5 times fast.

That includes companies OFFERING AI solutions and companies buying them.

Reading our previous reports, VERSES’ key client BlueYonder, is included squarely in that camp.

In a fortuitous and previously anticipated development for VERSES AI, every conversation slowed down.

However, the regulatory concerns that had come to the fore, ACCELERATED the company’s conversations in terms of business and deals, along with SCALE POTENTIAL.

EVERYONE else in the AI space situation got worse due to regulatory concerns (lack of explainability).

In fact, there are AT LEAST 13 Generative AI unicorns with a $1B valuation…go figure… but VERSES’ situation got EVEN BETTER.

We would be remiss here if not to mention some of the stellar talent assembled by VERSES at this juncture. Inasmuch as Einstein’s importance was to physics, Dr. Karl Friston is to AI.

His “free energy principle” is the E=mc2 for intelligence.

What most people don’t know is that Active Inference is a PROVEN biological approach to AI. It proves how any system, from a single cell organism to human scale systems basically learn in real time.

This is the formula for general intelligence…remember this….

KEY POINT:

VERSES, with the help of Dr. Friston is applying this to software, to make software that can think.

VERSES is also the ONLY company in the world that figured out how to build truly intelligent software!

What?…yup…..remember this because we think that is going to be EXTREMELY VALUABLE.

And also notable for investors to consider, they can use this to ENHANCE and STEER wannabes like ChatGPT, Bard, etc…

In conclusion, we will leave you to ponder the ramifications of this quote from VERSES CEO Gabriel Rene:

And if the regulators say those AI systems have to be explainable, they’re going to have to use our AI as guidance or governors, that are more intelligent even though they may be better at text understanding.

VERSES is the most legitimate to general intelligence and we are ALREADY demonstrating it now.

Yup, the company said it…..

In conclusion, relaying an exciting development for the company, a form of GIA is expected for the public to experience in Q4.

The general public will be able to “touch the product!”

Something to keep in mind…

Do you know what this quote says…and what company said it?..and why it could be VERY valuable?

Email us if you think you know the answer…

01101001 01100110 00100000 01100001 00100000 01110110 01100001 01101100 01110101 01100101 00101101 01100001 01101100 01101001 01100111 01101110 01100101 01100100 00101100 00100000 01110011 01100001 01100110 01100101 01110100 01111001 00101101 01100011 01101111 01101110 01110011 01100011 01101001 01101111 01110101 01110011 00100000 01110000 01110010 01101111 01101010 01100101 01100011 01110100 00100000 01100011 01101111 01101101 01100101 01110011 00100000 01100011 01101100 01101111 01110011 01100101 00100000 01110100 01101111 00100000 01100010 01110101 01101001 01101100 01100100 01101001 01101110 01100111 00100000 01000001 01000111 01001001 00100000 01100010 01100101 01100110 01101111 01110010 01100101 00100000 01110111 01100101 00100000 01100100 01101111 00101100 00100000 01110111 01100101 00100000 01100011 01101111 01101101 01101101 01101001 01110100 00100000 01110100 01101111 00100000 01110011 01110100 01101111 01110000 00100000 01100011 01101111 01101101 01110000 01100101 01110100 01101001 01101110 01100111 00100000 01110111 01101001 01110100 01101000 00100000 01100001 01101110 01100100 00100000 01110011 01110100 01100001 01110010 01110100 00100000 01100001 01110011 01110011 01101001 01110011 01110100 01101001 01101110 01100111 00100000 01110100 01101000 01101001 01110011 00100000 01110000 01110010 01101111 01101010 01100101 01100011 01110100

Artificial Intelligence Stock Reading

- The Best Artificial Intelligence Penny Stock VERSES AI

- Artificial Intelligence Stock with BIGGEST Potential

- Best Artificial Intelligence Stock Under $10

- What is BETTER than ChatGPT Generative Artificial Intelligence

- Generative Artificial Intelligence Regulation Solution

- How To Govern and Regulate Artificial Intelligence

- The BEST C3 AI Stock Alternative

- Next Generation Intelligence Patent Application

- The ONLY Adaptive Artificial Intelligence Stock

- Artificial Intelligence Stocks

- VERSES VRSSF 2023 Year End Summary

- The Story of VERSES AI VRSSF

- How VERSES AI Solves the Generative AI Problem

Bottom Line

Our nanocap marketing agency believes that creative content is better than spending money on ads.

Disclaimer

This information is for educational purposes only, it is NOT investment advice. It is published as an information service for highly speculative investors, and it includes opinions on buying, selling, and holding various stocks and other securities. VERSES AI Inc is an extremely high-risk investment, and it is HIGHLY LIKELY you can LOSE YOUR ENTIRE INVESTMENT. Investors should consult with their financial advisor BEFORE making ANY investment.

Prospective investors should carefully consider and evaluate all risks and uncertainties involved in an investment in this Company, including risks related to the Company’s limited operating history, the Company’s need for additional funding, the Company’s ability to successfully implement its growth strategy, conflicts of interest, the uncertainty of the use of available funds, the Company’s failure to manage growth, and reliance on strategic partnerships.

The information provided is obtained from sources believed to be reliable but is not guaranteed for accuracy or completeness. Any persons who buy, sell, or hold securities should do so with caution and consult with a broker or investment adviser before doing so.

Any discussions and pages may contain forward-looking statements that involve risks and uncertainties. A company’s results could differ materially from those in forward-looking statements or announcements.

All material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities.

At various times, we may own, buy or sell the securities discussed for investment or trading purposes. We (publishers, owners, and agents) are not liable for any losses or damages, monetary or otherwise, that result from the content shared.

Scott Shaffer is compensated by VERSES AI Inc (the “Company”) for publicizing information about the Company and its products.

The payment was made through both (i) a $50,000 signing bonus from the Company and (ii) the payment of cash compensation in the amount of $7500.00 per month for a period of 6 months starting February 2023.

As of April 14, 2023, the Company had (i) issued $50,000 and (ii) paid an aggregate of $15,000.00 in cash compensation for such services by Scott Shaffer. On April 17, 2023, The Company extended the contract for an additional 6 months and cash compensation was increased to $10,000 per month. Additional cash payments may have accrued since then.

Real Creative Agency

Digital Marketing Experts

Daily helping our most valuable asset "YOU" since 2005.