Published: October 22, 2025 | Published By: Real Creative Agency

Charlie’s Holdings OTCQB:CHUC stock is up more than 600% since March of this year.

What caused this move? Is it over…or just the beginning?

The Company is managed by Henry Sicignano, President, and Ryan Stump, co-founder and current Chief Operating Officer.

After his investor presentation at the LD Micro Conference in San Diego, I sat down with Mr. Sicignano to learn more about his background, his strategy for tobacco harm reduction, and his strategic plans for CHUC.

Our questions are in blue. We highlighted points we found to be noteworthy in RED.

Charlie’s Holdings OTCQB:CHUC

Charlie’s Holdings, Inc. (OTCQB: CHUC) is an industry leader in the premium vapor products space.

To provide adult smokers with better alternatives to combustible cigarettes, Charlie’s has developed a family of award-winning e-liquids as well as an array of compact, easy-to-use disposable vaping devices.

The Company’s products are sold around the world to select distributors, specialty retailers, and third-party online resellers.

Many store owners report that Charlie’s vapor products are among their fastest growing offerings.

Give us a little background on you, when and why you decided to join the company.

Henry Sicignano: My career in the tobacco industry began with Santa Fe Natural Tobacco Company. As VP and Marketing Director, I grew Natural American Spirit retail coverage from 5,500 stores to more than 40,000; increased distributor accounts from 127 to more than 425 and grew cigarette sales from $32MM to $145MM.

All the while, we maintained profitability and our commitment to producing “America’s best cigarette.” In 2002 I spear-headed the company’s sale to R.J. Reynolds Tobacco Company for $356 million (in an all-cash transaction).

Several years later, in 2010, I invested in, and started working for, 22nd Century Group (Nasdaq: XXII).

First as President, and later as CEO, I facilitated 22nd Century’s transformation from an LLC to an OTC publicly traded microcap, to an NYSE American listed company. (Under subsequent leadership, XXII moved to the Nasdaq.)

With the mission of reducing the harm caused by smoking, 22nd Century developed Very Low Nicotine (VLN) cigarettes to enable smokers to break their addiction to nicotine.

Growing XXII from a $5MM market cap with fewer than 100 shareholders… to hundreds of millions in market cap with more than 100,000 shareholders… my tenure was highly successful.

Unfortunately, after I left the Company in July 2019, XXII stumbled, horribly, with a flawed VLN commercialization strategy, an ill-advised foray into cannabis, and a misguided capital markets strategy.

Our plan at CHUC is to take our $80MM company (currently traded on the OTCQB) on the same trajectory that I took XXII… but with a foundation of strong revenues from products that are in full compliance with regulations in the markets we serve.

In so doing, I believe we will uplist to a national securities exchange, grow annual sales 10-20X, and achieve a market cap of well over $1 billion.

Give us a summary of what makes CHUC such a compelling story for a speculative investor.

Henry Sicignano: For starters – and to articulate precisely what attracted ME, personally, to CHUC in the first place – is Charlie’s mission: To provide adult smokers with better alternatives to combustible cigarettes.

With this commitment to doing what is good for smokers, the Company also strives to do well – exceedingly well, actually – for shareholders.

How can I convince you that these platitudes are more than just words??

By highlighting a few FACTS about management… Unlike many other micro-cap management teams, the executives at Charlie’s are not getting rich on their salaries.

The only way Charlie’s executives get rich is if/when they make SHAREHOLDERS rich.

Indeed, Charlie’s executives have personally invested enormous sums in the Company:

- Almost HALF the company is owned by insiders.

- Over the last two years, Ryan Stump and I, and one of our independent Board members, have loaned the company almost $4MM.

- Ryan and I voluntarily reduced our salaries, and our Board voted to suspend its own cash compensation

- Last month one director bought Charlie’s stock at (very) close to the 52-week high.

Why are INSIDERS so bullish??

CHUC has two distinct revenue drivers, each capable of producing literally hundreds of millions of dollars in sales:

PMTA Products. The Company’s most recent $1MM PMTA sale to one of the world’s largest tobacco companies shows that CHUC’s PMTA products (as a standalone asset) are worth north of $650MM.

In recent weeks we have fielded licensing inquires from other “Big Tobacco” companies, large Chinese companies, and a handful of smaller players in the United States.

We are currently in active discussions with three companies.

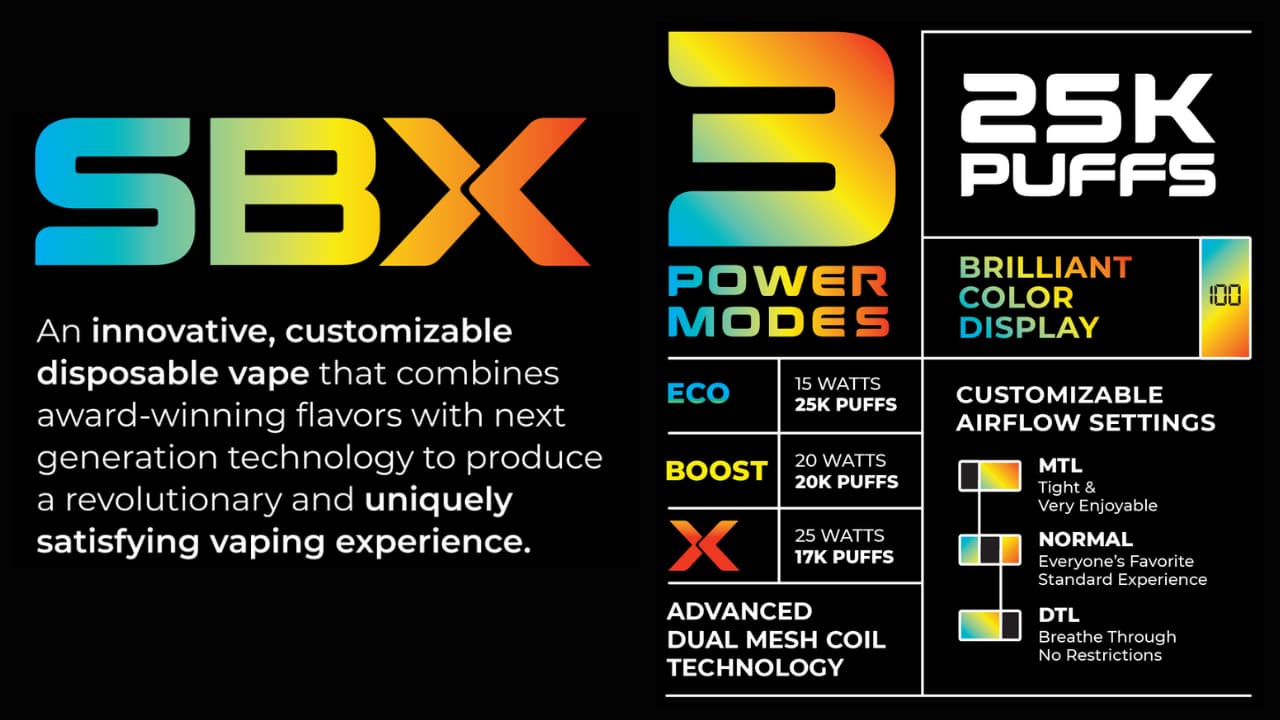

Non-Nicotine Products. SBX provides adult consumers with the same satisfaction that typical nicotine disposables provide… but without nicotine. Because SBX does not consist of, or contain nicotine from any source, SBX is not subject to FDA PMTA requirements.

Accordingly, SBX has considerable competitive advantages over conventional disposables and has many hundreds of millions of dollars of annual sales potential in “advantaged states” across the country.

OK… after reading Charlie’s Holding’s Annual Report and 2025 Letter to Shareholders, I understand that CHUC has several current and future revenue streams. Give us a summary of each (PMTA, SBX, US Manufacturing, Age Gating,)

Henry Sicignano: We intend to grow Charlie’s business, aggressively, in the coming months.

The strategic initiatives you mentioned represent our primary revenue-generating opportunities; here is a high-level overview of each:

- PMTA monetization: The Company believes Charlie’s 679 PMTA products, as a stand-alone asset, have a monetary value that far exceeds Charlie’s current market cap. To maximize the value of this portfolio, the Company intends to form strategic partnerships with additional Big Tobacco companies that value regulatory compliance in the vapor products marketplace.

- Grow nicotine-free SBX vapor product sales and retail distribution across the US.

SBX – with Metatine™ inside – does not consist of, or contain nicotine from any source and is therefore not subject to FDA Pre-Market Tobacco Application (“PMTA”) requirements. That said, SBX is indistinguishable from a conventional disposable vape; SBX provides adult consumers with the same satisfaction that typical nicotine disposables provide…

The SBX product line could disrupt the entire vape industry.

SBX represents the single largest, most important commercial opportunity in Charlie’s history.

- Charlie’s will launch a US-filled product line to meet domestic manufacturing requirements of large states.

Texas implemented a new law, Senate Bill 2024, effective September 1, 2025, that bans the sale and possession of certain vape products, including those manufactured or marketed as coming from China or certain other “adversary countries.”

Tennessee and other states have similar legislation pending.

To sell and distribute products in these markets, and as a first step toward manufacturing all of our products in the US, Charlie’s plans to launch a US-filled vapor product line in Q4 2025.

The Company’s new line will meet new domestic manufacturing requirements and will appeal, broadly, to adult consumers who prefer “Made in America” products.

- Develop patented age-gating technology; secure “product of merit” status with the FDA.

Currently, there is a need for age-gated product technologies that can satisfy or accommodate concerns the FDA has related to under-age youth access in the electronic nicotine delivery system (“ENDS”) market.

If our age-gated e-cigarettes-in-development are recognized as “products of merit” by the FDA, Charlie’s e-cigarettes could emerge among the select minority of flavored nicotine disposables able to be sold legally in the $8 billion US vapor products market.

Impressive Q2 with the PMTA sales and returning to profitability. Was this the first time you sold PMTAs? I notice that the value of each PMTA keeps increasing, what was the value of the last PMTA sold?

Henry Sicignano: So far in 2025, Charlie’s has sold 16 of the Company’s PACHA synthetic PMTA products and related assets to one of the world’s largest “Big Tobacco” companies.

Collectively, the sale price was $7.5 million, plus a contingent payment of up to $4.2 million. (Not including future contingent payments, our initial “sale” included a cash payment of approximately $416,000 per SKU for each of 12 PMTA Products; our second “sale” included a cash payment of $500,000 per SKU for each of 3 PMTA Products; our third “sale” included a cash payment of $1MM for one PMTA Product.)

So, you have 679 PMTAs left… Based on CHUC’s last sale, CHUC’s PMTA portfolio has an imputed value of more than $650MM… but your market cap is a tiny fraction of that. What is the market missing?

Henry Sicignano: In short, I do not believe the market realizes – or understands – the value of Charlie’s PMTAs.

Based on our initial PMTA Product sales, and given that Charlie’s continues to own 679 PMTA Products, we believe that our PMTA portfolio, as a stand-alone asset, has a monetary value that far exceeds Charlie’s $80MM current market cap!

To maximize the value of this portfolio, the Company definitely intends to form strategic partnerships with additional “Big Tobacco” companies that value regulatory compliance in the vapor products marketplace.

Share update on traction with Big Tobacco new product with your PMTAs…is the industry watching this? Are you talking with any other players about selling/licensing PMTAs, or related business ventures?

Henry Sicignano: After news broke of Charlie’s initial PMTA asset sale, the Company and our counsel, fielded numerous inquiries regarding our remaining 679 PMTA Products from several of the world’s largest “Big Tobacco” companies, large Chinese companies, and a handful of smaller players in the United States.

Though we have not yet come to a commercial agreement with any of these suitors, we are currently in discussions around licensing possibilities with three companies.

Is it fair to say that CHUC has great flavors and PMTAs… but little shelf space, like a Big Tobacco player?

Henry Sicignano: Since Charlie’s founding by Brandon and Ryan Stump in 2014, our Company has always focused on – and excelled in – the creation and development of distinctive and uniquely satisfying e-liquid flavors. Indeed, since the dawn of our industry Charlie’s award-winning flavors have been recognized as “Best in Show,” “Most Popular,” and “Most Satisfying” in numerous competitions around the globe.

By applying our extensive experience in the e-liquids industry and in the creation of award-winning flavors, CHUC created a vast library of detailed products recipes… and then devoted very substantial resources to utilizing our meticulously assembled product library in the submission of PMTAs to the FDA in August 2020 for the Company’s best-selling e-liquids with plant-derived nicotine; and in May 2022 for the Company’s synthetic nicotine e-liquids and disposable vapes.

All the while, Big Tobacco companies ignored innovation… and simply filled hundreds of thousands of shelves across the US with their “plain vanilla” tobacco-flavored products with outdated technology.

This dichotomy is precisely the source of… CHUC’s current market opportunity.

SBX: Give us an idea of how this product is better than what is currently on the market. What makes SBX attractive to retailers and consumers?

Henry Sicignano: SBX, with Metatine, is indistinguishable from a conventional disposable vape; SBX provides adult consumers with the same satisfaction that typical nicotine disposables provide… but without nicotine.

Currently available in 14 award-winning flavors, SBX is most commonly described as “GREAT TASTING.”

In a Company-sponsored focus group survey of adult consumers who vape, Charlie’s SBX Disposables were overwhelmingly preferred over Juul tobacco- flavored vapes.

Of 306 survey participants, 287 preferred SBX over Juul.

“Compared to Juul, SBX provides many MORE FLAVOR options, UNBEATABLE TAX ADVANTAGES, and THOUSANDS MORE PUFFS!”

SBX Disposables provide significantly more vape… and surprisingly better taste than market-leading disposables. With an 18ml capacity, SBX offers 25,000 uniquely satisfying puffs.

SBX is greatly expanding Charlie’s retail distribution through chain convenience stores that wish to carry flavored disposable vapes but will not stock products that are in violation of the FDA’s PMTA review process.

Because SBX products do not consist of, or contain, nicotine from any source and are therefore not subject to FDA PMTA requirements, SBX enables retailers to carry LEGAL flavored vapes that consumers prefer.

In how many states is SBX now offered?… And what is the Company’s ultimate goal?

Henry Sicignano: The different states across our nation present a “soup” of regulatory inconsistencies and disparate policies with respect to flavored disposable products.

For this reason, we have prioritized initial SBX sales efforts in “strategically advantaged markets” like Arkansas, Kentucky, Mississippi, Louisiana, New York, and North Carolina.

That said, Charlie’s is thrilled that SBX has facilitated dozens of new relationships with regional wholesalers and distributors across the entire country, including some of the largest national distributors.

Given all these factors, and realizing that Charlie’s has a well-established network of “legacy partners,” we believe that SBX is currently available, through select retailers, to adult consumers in nearly every state.

Our goal is to increase the depth of SBX distribution in all the markets Charlie’s serves.

Given that Charlie’s SBX Disposables are overwhelmingly preferred over Juul tobacco-flavored vapes (as highlighted by our Company-sponsored focus group survey), if SBX is able to achieve just a fraction of Juul’s retail distribution, Charlie’s sales will grow to several hundred million dollars annually.

What is the retail target market? Convenience stores, big retailers?

Henry Sicignano: Our goal is to have one of the largest vape brands in the US for adult consumers. As state regulations continue to evolve, the advantaged markets for SBX continue to grow.

There are already more than a dozen states where SBX enjoys some level of competitive advantage relative to conventional nicotine products.

SBX is not subject to nicotine tax, nicotine flavor bans, and many nicotine vape registries in numerous states.

By early 2026, SBX will be virtually the only flavored 25K Puff disposable option for adult consumers in seven states… SBX will enjoy some level of competitive advantage in a many more states… and SBX will begin to be known by adult consumers nationwide.

What’s more, in the next 30 days, Charlie’s expects to begin offering a US-assembled and filled Pachamama 25K disposable for two of the largest vapor products markets in the US… Tennessee and Texas.

Our plan is to offer Pachamama 25K nationwide – in the US manufactured format – by Q1 2026.

Your sales reps’ posts on LinkedIn and the new jobs being advertised by CHUC suggest that SBX is getting traction. Can you give us any guidance on SBX’s success in the market?

Henry Sicignano: All Charlie’s sales reps have done an incredible job opening new accounts and markets nationwide.

As SBX, specifically, and CHUC, more broadly, continue to grow, we are rolling out strategic initiatives that will support short- and long-term Company objectives.

We plan to attend (i) dozens of our wholesale customers’ tradeshows to grow CHUC product sales within our Key Accounts’ customer bases, (ii) retail store activation events, and (iii) brand-building adult consumer awareness campaigns.

We have already started, and plan to continue, adding permanent employees as well as independent contractors to support retail “blitzes” in high value markets throughout the US.

Can you give us an idea of your unique market opportunity with the recent FDA/state crackdown, Trump tariffs, and the Chinese banned vapes?

Henry Sicignano: Charlie’s is one of a select group of companies that has made every effort to comply with FDA PMTA requirements for nicotine products.

Having invested more than $7MM in our PMTAs, Charlie’s has been frustrated by the fact that most of our competitors have simply ignored the FDA.

Foreign companies and unscrupulous domestic competitors have sold billions of dollars – LITERALLY – of illicit product while Charlie’s has remained steadfastly committed to regulatory compliance.

Accordingly, we are strong proponents of regulatory enforcement of existing compliance standards and establishment of a truly level playing field for all players in the US vape industry.

The recent FDA/state crackdown on illicit products significant benefits Charlie’s – and our SBX product line, in particular.

In a new environment marked by increased regulatory enforcement, we believe that SBX represents the single largest, most important commercial opportunity in Charlie’s history… we believe that SBX could generate many hundreds of millions of dollars in revenue for the Company.

States are cracking down on illegal vapes. Texas, the largest vape market in the US, is now requiring only US-filled vapes to be sold. Is this what precipitated CHUC’s plan to begin manufacturing in the US?

Henry Sicignano: Yes! Charlie’s will launch a US-filled product line to meet domestic manufacturing requirements of several large states.

As you suggested, Texas implemented a new law, Senate Bill 2024, effective September 1, 2025, that bans the sale and possession of certain vape products, including those manufactured or marketed as coming from China or certain other “adversary countries.” Tennessee and other states have similar legislation pending.

To sell and distribute products in these markets, Charlie’s plans to launch a US-filled vapor product line in Q4 2025.

The Company’s new line will meet new domestic manufacturing requirements and will appeal, broadly, to adult consumers who prefer “Made in America” products.

How much product will the new facility produce once it is fully operational?

Henry Sicignano: Before year’s end, we are hoping to have a capacity to produce 500,000 units per month.

If all goes well with our California “test facility,” we hope to open a larger facility in the Southwestern US that will have the capacity to produce disposable vapes representing at least $12MM/month.

Age gating tech… share your view on why this is important for Charlie’s.

Henry Sicignano: To address concerns raised by the FDA over the use of Electronic Nicotine Delivery System (“ENDS”) products by underage consumers, Charlie’s and several other companies have invested very significant time and financial resources to develop vapor products that might be “enabled” (or made functional) only after the adult user is age-verified.

Charlie’s Age Gating project leader, Dr. Edward Carmines, is a world-renowned expert in the technical aspects of all types of e-cigarettes, oral tobacco, tobacco-free products, cigars, and cigarettes.

Having successfully navigated the FDA’s Substantial Equivalence, PMTA and Modified Risk Tobacco Product Application (“MRTPA”) pathways for literally hundreds of products, Dr. Carmines is developing proprietary technology with Charlie’s Research and Development team to enable the Company, upon receipt of an FDA marketing order, to offer a controlled e-cigarette device that is made operable only upon activation by an age-verified adult consumer.

By launching this strategic initiative, Charlie’s has endeavored to make the Company’s PACHA disposable e-cigarette products among the select few – or the only – flavored e-cigarettes able to be sold legally in the United States.

If the Company’s “age-gated” nicotine disposable e-cigarettes-in-development are recognized as “products of merit” by the FDA, Charlie’s e-cigarettes could emerge among the select minority of flavored e-cigarettes able to be sold legally in the $8 billion U.S. market.

You have discussed uplisting to a major exchange… what do you need to qualify? Any target date for that?

Henry Sicignano: It is our intention to uplist as early as Q1 2026.

Charlie’s already meets the substantial majority of the initial requirements for certain Nasdaq and NYSE American listing standards. To enable us to meet minimum share price requirements, shareholders have already authorized (in the spring of 2024) a 10:1 reverse split.

The NYSE listing process itself can take up to 10-12 weeks in length.

The Nasdaq listing process can take from 6 to 12 weeks in length. When Charlie’s is able to comfortably meet all of the initial listing standards of at least one of the national securities exchanges, it is our intention to uplist immediately.

We believe this achievement will significantly improve our capital markets appeal to a broader range of investors, increase our liquidity, and ultimately, will result in a higher market cap for the Company.

In the near term, we believe that success in EITHER: monetizing the Company’s PMTA-submitted PACHA synthetic nicotine products, OR growing SBX sales and distribution through chain convenience stores in select markets across the United States will enable us to meet substantially all the minimum requirements for both the Nasdaq and the NYSE American exchanges.

Q3 results… expected Mid November? Do you still expect the Company to be profitable?

Henry Sicignano: Yes. Q3 results will be released in mid-November. I am pleased to report that organic sales of our core product lines will show an increase from both Q3 2024 as well as Q2 2025…. And the Company remains profitable.

Any intention to raise money after this move in your share price?

Henry Sicignano: The company is PROFITABLE and GROWING so we see no need to raise capital. And we intend to keep it that way!

As (very) large shareholders, management’s interests are perfectly aligned with the interests of our shareholders. Accordingly, management detests dilutive equity financings (and associated warrants).

Though we would “never say never” about initiating a strategic equity raise, Ryan and I hold Charlie’s equity near and dear to our hearts and we would consider an equity raise only in the very rare circumstance that the funds we would raise would be used to fund an exceedingly strategic/profitable investment for the benefit of our shareholders.

You really have shared a highly compelling story… To conclude, what should an investor take away when s/he is thinking about placing a bet on CHUC?

Henry Sicignano: In short, Charlie’s has a strategic plan, a product portfolio with massive intrinsic value, and a highly experienced management team with a TON of skin in the game.

Surely there will be bumps in the road ahead. But we have already proven the enormous value of our PMTA Products… and we have established CHUC as a PROFITABLE, GROWING company with truly outstanding potential.

Inevitably we will face challenges. Nevertheless, on balance, we anticipate a measured, steady path forward… hopefully to a market cap of well north of $1 billion.

For all these reasons, we think that Charlie’s represents an excellent opportunity for investors.

Other Articles About Charlie’s Holdings OTCQB:CHUC

- OTCQB:CHUC Best Nicotine Vape Stock

- Big Tobacco Quietly Acquires CHUC PMTAs

- OTCQB:CHUC Investor Deck

- CHUC’s Latest Shareholder Letter

Safe Harbor Statement: This interview contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding the Company’s overall business, existing and anticipated markets and expectations regarding future sales and expenses. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “could,” “intend,” variations of these terms or the negative of these terms, and similar expressions, are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. The Company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: the Company’s ongoing ability to quote its shares on the OTCQB; whether the Company will meet the requirements to up-list to a national securities exchange in the future; the Company’s ability to successfully increase sales and enter new markets; whether the Company’s PMTA’s for its nicotine-containing products will be authorized by the FDA, and the FDA’s decisions with respect to the Company’s future PMTA’s for nicotine products; the Company’s ability to manufacture and produce products for its customers; the Company’s ability to formulate new products; the acceptance of existing and future products; the complexity, expense and time associated with compliance with government rules and regulations affecting nicotine, synthetic nicotine, and products containing nicotine substitutes; litigation risks from the use of the Company’s products; risks of government regulations; the impact of competitive products; and the Company’s ability to maintain and enhance its brands, as well as other risk factors included in the Company’s most recent quarterly report on Form 10-Q, annual report on Form 10-K, and other SEC filings. These forward-looking statements are made as of the date of this interview and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this interview as a result of new information, future events or changes in its expectations.

Artificial Intelligence Stock Reading

- The Best Artificial Intelligence Penny Stock VERSES AI

- Artificial Intelligence Stock with BIGGEST Potential

- What is BETTER than ChatGPT Generative Artificial Intelligence

- Generative Artificial Intelligence Regulation Solution

- How To Govern and Regulate Artificial Intelligence

- The BEST C3 AI Stock Alternative

- Next Generation Intelligence Patent Application

- The ONLY Adaptive Artificial Intelligence Stock

- Artificial Intelligence Stocks

- VERSES VRSSF 2023 Year End Summary

- The Story of VERSES AI VRSSF

- How VERSES AI Solves the Generative AI Problem

Disclaimer

This communication is a paid advertisement for Charlies Holdings. to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.This communication is a paid advertisement for Charlies Holdings to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. Real Creative Agency, and their owners, managers, employees, and assigns were paid by the Company to create, produce and distribute this advertisement. This compensation should be viewed as a major conflict for this presentation to be unbiased.On August 7, 2025, Charlies Holdings agreed to pay Scott Shaffer (i) $5,0000 per month for 6 months (ii) issue 300,000 restricted shares of Charlies Holdings (CHUC).This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Company purport to provide a complete analysis of the Company or its financial position. The Company is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the government filings. Investing in securities is speculative and carries a high degree of risk.

Real Creative Agency

Digital Marketing Experts

Daily helping our most valuable asset "YOU" since 2005.