Published: August 12, 2025 | Published By: Real Creative Agency

Most people aren’t aware of it because there weren’t any press releases, but one of the biggest players has been quietly acquiring 16 of OTCQB:CHUC 650+ PMTAs.

Find out which Big Tobacco company it is HERE

Charlie’s Holdings OTCQB:CHUC is a U.S. vape company with one of the largest portfolios of FDA-submitted synthetic nicotine products.

The recent share price has attracted a lot of attention.

Here is why the company could be very attractive to Big Tobacco.

Charlie’s Holdings OTCQB:OTC Facts

- Estimated value of full PMTA portfolio (679) $600MM+ *

- $11.7MM from first 16 PMTA product sales by RJ Reynolds

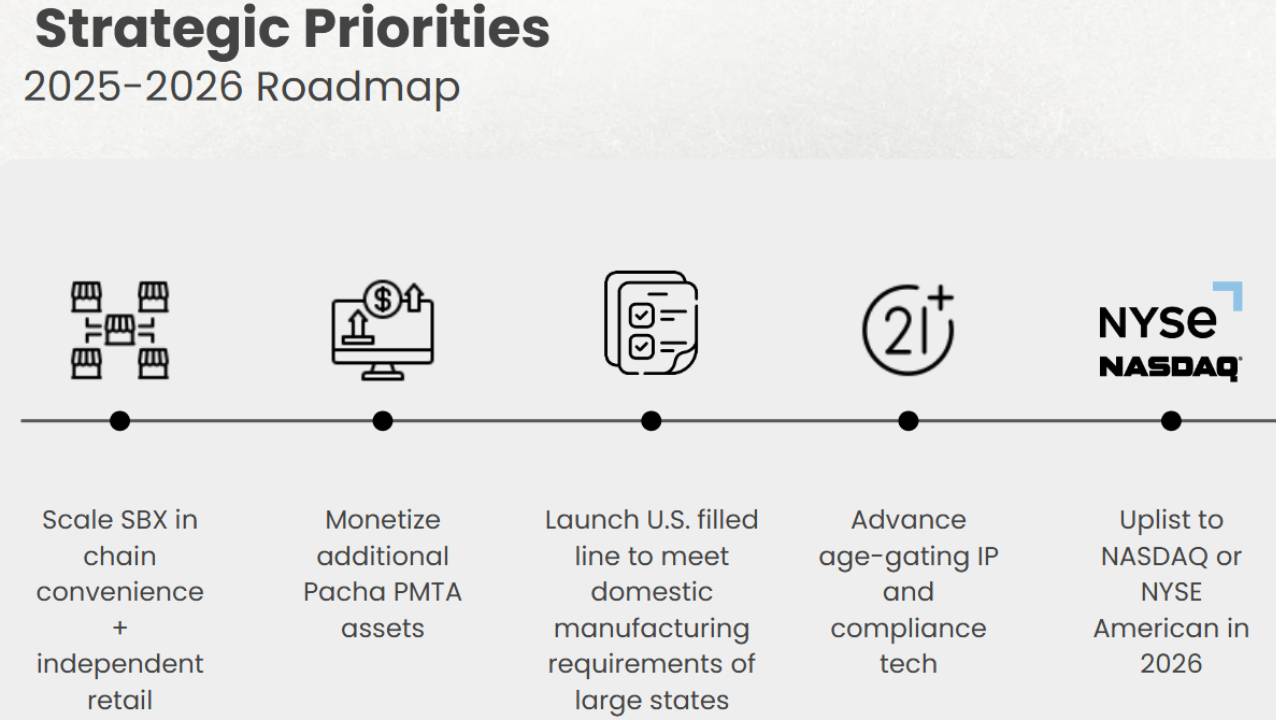

- Nicotine free SBX (NOT subject to FDA review) rolling out to mass market convenience stores in Q3

- SBX preferred 15 to 1 over Juul in consumer testing

- Q2 Earnings expected to show drastic increase in revenue and the Company’s return to profitability

- Management and Founders own 45.3%

- Global footprint in 90+ countries

- Preparing a “Made in America” vape line to meet new state regulations

- Developing age-gating tech that could help lock down a legal path for flavored disposables in the U.S

- Management says either the PMTA monetization… or SBX revenue… could be enough to uplist to Nasdaq or NYSE American

Why CHUC’s PMTA Portfolio Is Attractive to Big Tobacco

Many don’t realize this, but when the e-cigarette was introduced, it not only created a new product category, but also allowed China to break the stranglehold that Big Tobacco had on the “smoking” industry.

This new “cigarette” didn’t require growing tobacco and, more importantly, didn’t require getting FDA approval.

The Chinese took advantage of this opportunity and flooded the US market with nicotine vapes.

The FDA recognized the danger of this “drug” being sold in the US without any quality assurance, so they required any company selling a tobacco product ( including vape products (ENDS or electronic nicotine delivery systems) on the market as of August 8, 2016, to file a Premarket Tobacco Product Application (PMTA) by September 9, 2020.

When the FDA started cracking down on tobacco-derived products, many companies introduced synthetic nicotine products. The FDA gained regulatory control over all nicotine products, mandating additional PMTAs for synthetic nicotine products introduced into the market by May 2022.

CHUC filed over 500 disposable vapes and 200+ e-liquids PMTAs before this May 2022 deadline.

This portfolio of 650+ PMTAs, primarily for flavored vapor products, is a rare and valuable asset, as only 34 e-cigarette products have been authorized out of over 26 million PMTA submissions.

These PMTAs offer Big Tobacco companies a “shortcut” and “legal backdoor” into flavored vape sales, saving tens of millions in compliance, testing, and development costs.

Chinese Tariffs, Patent Infringement and State Laws Make CHUC A Possible Buyout

If you follow the timeline, RJ Reynolds’ acquisition of CHUC’s PMTAs makes sense.

On March 31, 2025, Altria stopped selling NJOY Ace e-cigarettes in the US due to a US International Trade Commission (ITC) ruling that the device infringed on patents held by Juul Labs

The number one selling vape in the US, Chinese owned Geek Bar, like many other disposable vapes, has not obtained the required Premarket Tobacco Product Application (PMTA) from the FDA, making their presence on the market technically illegal.

On April 4, 2025 the Trump Administration announced Vaping products imported from China, which includes the number one selling Chinese Geek Bar, was subjected to a 79 percent tariff rate.

Less than 2 weeks later, R.J. Reynolds sees the opportunity to take market share from Geek, and acquires 12 of CHUC’s PMTAs for $5m plus a royalty of $4.2M

Since then, Reynolds has acquired 4 more, with the latest purchase of $1M on August 8.

This acquisition could allow a Big Tobacco player to legally sell flavored vapes in the US. Based on the demand for flavored vapes versus tobacco flavored, could generate billions in revenue.

The same day Reynolds buys that CHUC PMTA, Juul filed a patent infringement against NJOY and Altria.

Meanwhile, Altria is paying for shelf space in approximately 100,000 stores with no legal product to sell.

If you were Altria, what would you do? (our thoughts)

- They could offer to sell CHUC’s SBX (doesnt required FDA approval) in those 100,000 stores knowing it just beat Juul in a taste test.

- They could make an offer for a few of CHUC’s PMTAs, but that could trigger a bidding war for the rest of the PMTAs (or for the company)

- They could make an offer for the entire company, or at least pay for a first right of refusal.

- They could acquire shares in the open market under alias brands to avoid alerting other Big Tobacco players.

- They could just wait it out and see what decisions the FDA makes on their PMTAs

It might help to know that according to the company, an unnamed “Big Tobacco” company offered to buy CHUC a few years ago for a 9-figure sum.

Should Big Tobacco Buy This Vape Penny Stock?

It appears that some investors are piecing together the “PMTA pieces” and realizing that JUST CHUC’s PMTA portfolio valuation drastically exceeds the current market cap.

Having secured $7.5M with just 16 PMTAs, the company is in a much better position to negotiate monetization (not just sell them, but sell and license for continued revenue) of its extensive PMTA portfolio.

It is this royalty revenue possibility that could turn “little CHUC” into a major player in Big Tobacco in less than a year.

In addition, CHUC’s non-nicotine product is gaining traction, another attractive offering for a Big Tobacco player.

At last week’s Shareholder Meeting, the company discussed its plans for a Made in the USA Vape vision and the age-gating technology.

We will have a complete CHUC writeup soon but wanted to get this update out after RJ Reynolds news and the market activity.

Find CHUC’s Latest Investor Deck

CHUC’s Latest Shareholder Letter

* On August 8, 2025 RJ Reynolds Vapor acquired 1 of CHUC’s PMTAs for $1MM. CHUC’s PMTA portfolio consists of over 650 PMTAs

Artificial Intelligence Stock Reading

- The Best Artificial Intelligence Penny Stock VERSES AI

- Artificial Intelligence Stock with BIGGEST Potential

- What is BETTER than ChatGPT Generative Artificial Intelligence

- Generative Artificial Intelligence Regulation Solution

- How To Govern and Regulate Artificial Intelligence

- The BEST C3 AI Stock Alternative

- Next Generation Intelligence Patent Application

- The ONLY Adaptive Artificial Intelligence Stock

- Artificial Intelligence Stocks

- VERSES VRSSF 2023 Year End Summary

- The Story of VERSES AI VRSSF

- How VERSES AI Solves the Generative AI Problem

Disclaimer

This communication is a paid advertisement for Charlies Holdings. to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.This communication is a paid advertisement for Charlies Holdings to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. Real Creative Agency, and their owners, managers, employees, and assigns were paid by the Company to create, produce and distribute this advertisement. This compensation should be viewed as a major conflict for this presentation to be unbiased.On August 7, 2025, Charlies Holdings agreed to pay Scott Shaffer (i) $5,0000 per month for 6 months (ii) issue 300,000 restricted shares of Charlies Holdings (CHUC).This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Company purport to provide a complete analysis of the Company or its financial position. The Company is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the government filings. Investing in securities is speculative and carries a high degree of risk.

Real Creative Agency

Digital Marketing Experts

Daily helping our most valuable asset "YOU" since 2005.